WRITE TO YOUR LEGISLATORS AND GOV. NEWSOM AND ASK THEM NOT TO RAISE CANNABIS TAXES IN 2025

Update 5/8/2025 – While AB 564 goes to Assembly Appropriations, the Governor and both legislative houses are finalizing their budgets for the year. Please Take Action on our New Alert Targeted at the Full Legislature and the Governor, asking them not to increase cannabis taxes in 2025.

SACRAMENTO 5/5/25: California business owners, activists and patients were joined by Humboldt, Nevada, and Alameda counties and the city of Sacramento in support of AB 564, to freeze the cannabis excise tax, at the Assembly Revenue & Tax committee.

The bill passed through the committee by a vote of 6-0, with “Aye” votes from Chair Mike Gipson and Asms. Quirk Silva, McKinnor, Robert Garcia, Carillo (for Bains), and DeMaio. Co-chair Ta did not vote. It will now head to the Appropriations committee.

Speaking in favor of the bill were Amy Jenkins from the California Cannabis Operators Assn. She noted that a recent report from the state Department of Cannabis Control confirmed that California’s excise taxes and licensing fees are 124% and 160% higher than Michigan’s, and that altogether CA’s taxes and fees account for 77% of cannabis’s wholesale value. “That is not a sustainable framework,” she said, adding that 12,00 jobs in California’s cannabis industry were lost in in 2022 and 5000 in 2023. Also, CDTFA just released now data indicating the cannabis industry owes $980 million in outstanding taxes, penalties and interest.Prop. 64 mentions at least 5 times that the taxes should be structured so that the legal market outstrips the illicit one, Jenkins continued. “Yet we are seeing the opposite….AB 564 is not a tax break, it’s economic triage.”

Kristen Heidelbach from UFCW hammered home the point that, “These are union jobs.” UFCW represents over 5000 cannabis workers through 9 locals. “We have been screaming that The British are coming! for a while, but now we have an untaxed hemp industry that doesn’t contribute to fines and fees….this is not a tax decrease, this is simply a freeze. We’re just trying to fight another day.”

Cal NORML’s Dale Gieringer (pictured) spoke in support as a sponsor of the bill, and on behalf of those who wrote 1,420 letters to their Assemblymembers (via Cal NORML’s Action Alert, which has now gathered 1,600 letters.) Thanks to all who wrote letters and came to show their support! Please also:

WRITE TO YOUR LEGISLATORS AND GOV. NEWSOM AND ASK THEM NOT TO RAISE CANNABIS TAXES IN 2025

Failed Businesses Don’t Pay Taxes

Inactive cannabis licenses are climbing as California companies struggle to stay in business. Inactive licensees don’t make money, or pay taxes. Many of the inactive licenses are equity businesses, who are already facing a de facto tax increase as the vendor compensation program for cannabis equity businesses is set to expire on 12/31/25.

California’s licensed retail footprint has flatlined at roughly 1,225 active stores since mid-2023, as 57% of the state’s cities and counties still prohibit cannabis dispensaries, according to the California Department of Cannabis Control (DCC).

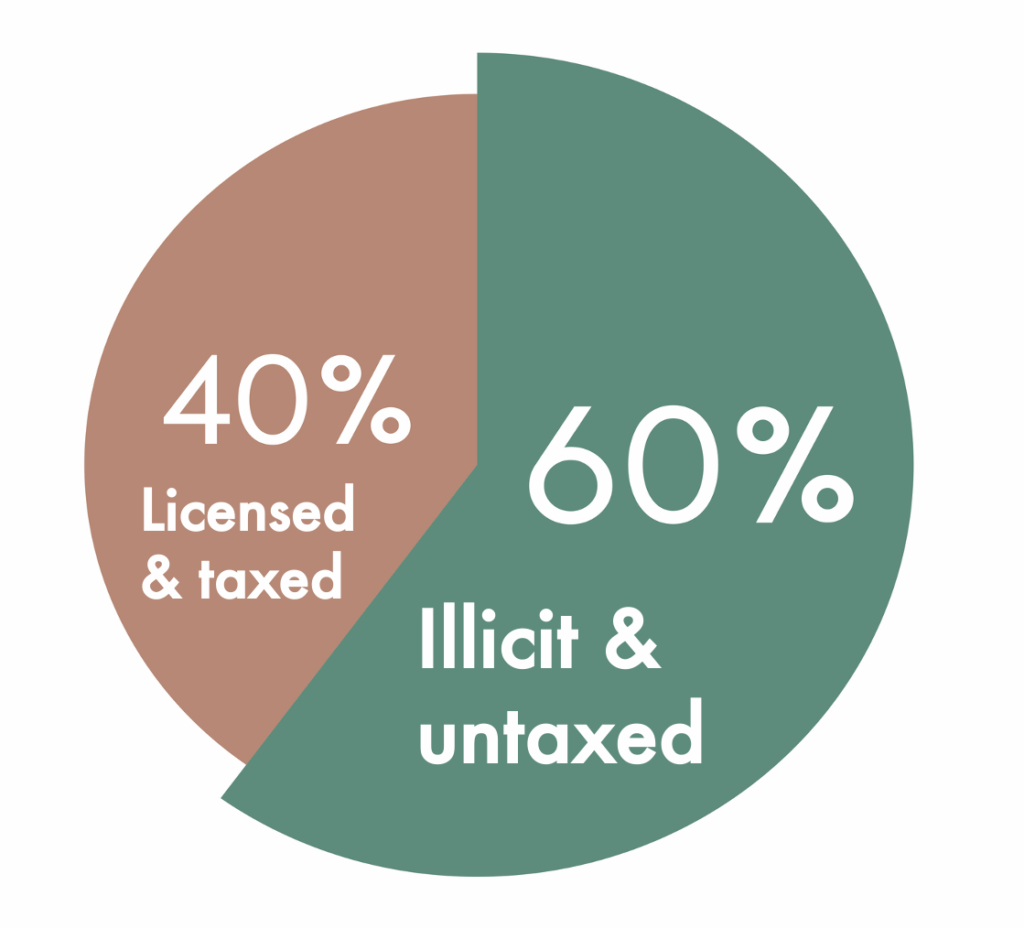

6 out of every 10 cannabis sales in CA is from the illicit, untaxed market

A new report from the CA Department of Cannabis Control estimates that total California cannabis consumption is 3.8 million pounds, and that only 1.4 million pounds is sold from the licensed market. This means the majority of cannabis sold in California is untaxed. High tax rates in the licensed market are a big reason consumers look elsewhere for their cannabis.

Total excise tax collected in calendar year 2024 was $593.6 million compared to $626 million in calendar year 2023. Cannabis tax revenues peaked in fiscal year 2021-22 at over $800 million.

Total cannabis tax revenue from the fourth quarter 2024 was $219 million, including $127.8 million in excise taxes and $91.2 in state sales tax, according to the CDTFA. This is down 13.7% from the total $253.8 million in the third quarter. The excise tax dropped 14.9% from $150.1 million.

California lost 17,600 cannabis jobs in the last two years

California led the nation with 12,600 cannabis jobs lost in 2023 and 5,000 cannabis jobs lost in 2024, according to industry employment agency Vangst.

Other states with lower taxes outperform CA’s cannabis sales

Michigan, with its 10% state excise tax that is shared with local jurisdictions (which have no taxes of their own), is pointed to as a model for a successful roll-out of marijuana legalization. Missouri has a 6% state excise tax and caps local taxes at 3% (California has no such cap).

If California were on par in per capita sales with Michigan or Montana, it would be generating an estimated $13 billion in annual sales, and the state would be collecting substantially more tax revenue. Instead, the taxable sales for cannabis in 2024 was $4.6 billion. Source

Adding in state sales tax and local taxes, cannabis products are taxed at a rate as high as 38% (44% if delivered) in California. Since local taxes are compounded at the retail level, including packaging and service fees, increasing the excise tax to 19% will increase the total tax on cannabis to as much as 48%. This is far more than comparable products like beer, wine and cigarettes.

Please take action on our new alert targeted at the full legislature and the Governor, asking them not to increase cannabis taxes in 2025.

The Cannabis Tax Account Has a Budget Surplus

In fiscal year 2023-2024, the Cannabis Tax Account had a balance of $469.6 million and took in $629.4 million in taxes, according to the DCC’s Condition and Health of the Cannabis Industry in California supplemental report. But it spent only $560.5 million because legislators contributed $150 million from the general fund. For this fiscal year, estimated revenue is $603.7 million and expenditures are nearly $674.0 million, leaving a balance of $468.2 million.

For fiscal year 2025-26, the governor’s budget projects that cannabis tax revenues will be about $761.9 million, assuming the excise tax will increase to 19% on July 1. Expenditures are budgeted at only $610.2 million.

Who is Opposing a Cannabis Tax Freeze?

AB 564 is being opposed by groups that receive cannabis tax money for Youth Education Treatment and Prevention Programs, which have not been evaluated for their effectiveness, despite legislation requiring accountability.

In 2022, Governor Newsom signed AB 2925 (Cooper), requiring DHCS to provide to the Legislature by July 10, 2023 a spending report of funds from the Youth Education Prevention, Early Intervention and Treatment Account (YEPEITA) paid for by the Cannabis Tax Fund for the FY 2021–22 and 2022–23. In addition, the 2022 Budget Act stated that by March 1, 2023, and on the same date until 2025, the DOF shall submit a report to the Legislative Analyst’s Office, relevant policy committees, and the relevant budget committees of each house of the Legislature on Cannabis Tax Fund Spending.

Both AB 2925 and the 2022 Budget Act called for evaluations of YEPEITA programs, with AB 2925 stating: “The departments shall periodically evaluate the programs they are funding to determine the effectiveness of the programs.” Although DOF has provided some data in Budget Committee hearings about YEPEITA program expenditures, that data is incomplete, and no evaluations of the programs have been provided by DHCS.

We expect these groups to oppose AB 564 before the Assembly Revenue and Taxation committee hearing on Monday, May 5 at 2:30 PM. Cal NORML encourages all, particularly constituents of committee members, to continue to contact their Assemblymembers.

This article was originally published by California NORML and has been republished here with permission from Cal NORML by Beard Bros Media.