SAN DIEGO, CA — Beginning May 1, San Diego’s local cannabis-business tax climbs from 8 percent to 10 percent, placing the city among the state’s costliest jurisdictions for licensed retailers. Operators are already bracing for an additional hit on July 1, when California’s statewide cannabis excise tax—mandated by Prop 64’s inflation adjustment—jumps from 15 percent to 19 percent . Combined with the standard 7.25–8.75 percent sales-tax range and a web of compliance fees—and with penalties that can reach 50 percent for late payments—the effective tax burden on a legal purchase in San Diego will hover near 37 percent of the final shelf price.

A Tight Squeeze for Retailers and Consumers

According to the city clerk’s filing of Ordinance O-21434 (adopted 3 March 2025), officials expect the 2-point local increase to add roughly $4 million to the General Fund if gross receipts remain stable. Industry insiders argue stability is far from guaranteed:

“It’s truly unfortunate that San Diego has chosen to raise taxes on an already over-burdened cannabis industry—punishing legal operators for the city’s own poor budgeting decisions.”

Armand King, Community Advocate

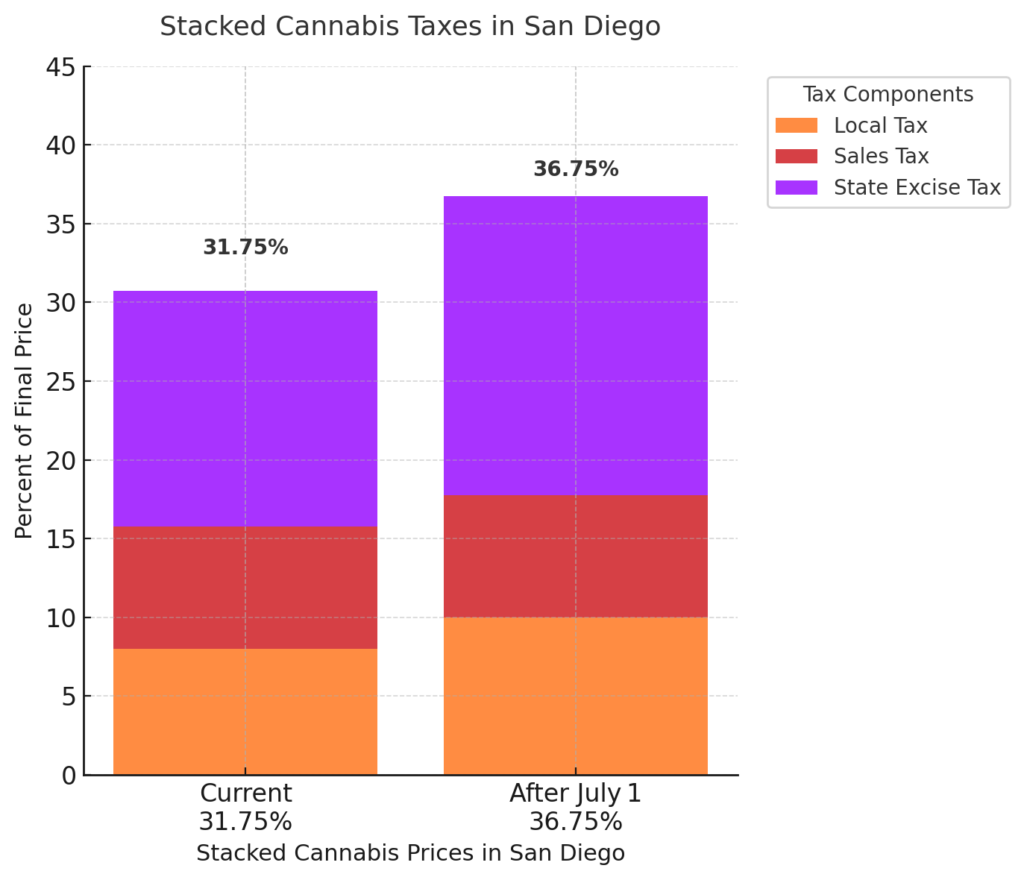

Although the new 10 percent local rate is levied on retailers and not on manufacturers, industry analysts say shoppers will ultimately absorb the full “tax stack.” Today a San Diego purchase carries an 8 percent local cannabis tax, the 7.75 percent sales tax, as well as a 15 percent state excise tax—adding roughly 31.75 percent to the shelf price. As the stacked-bar chart shows, that burden will climb to almost 37 percent when the excise tax rises to 19 percent on July 1 and the local rate moves to 10 percent.

Dispensaries contend that they’ll have to pass the extra cost on to consumers, given razor-thin margins. This will widen the legal market’s price gap with unregulated sellers and push cost-conscious buyers toward cheaper illicit options or growing their own cannabis at home. Californians over the age of 21 can grow up to 6 cannabis plants under state law.

Operators note that average wholesale flower prices are down more than 40 percent year-over-year, yet compliance costs—ranging from security upgrades to state metric tracking—continue to climb.

“The combined 6 percent jump in city and state taxes this year is yet another blow to an already struggling industry.” – Alana Heilman, GM & VPO, Mankind Dispensary

Regional Flight or Underground Pivot?

Local tax data submitted to the California Department of Tax and Fee Administration (CDTFA) show San Diego collected $15.87 million in cannabis-business taxes during FY 2024 —a figure officials hope to boost with the new rate. But retailers warn higher levies could send customers to nearby La Mesa or Lemon Grove, where local cannabis taxes remain 4–6 percent, or to the still-robust illicit market

“By increasing taxes, the city will push customers to lower-tax jurisdictions—or to untested, unregulated products.” – Kelly Hayes, Cannabis Attorney

State-Level Relief on the Horizon?

One bill in Sacramento—Assembly Bill 564—would freeze the state excise tax at 15 percent, blocking July’s scheduled jump. Many operators see the measure as a critical backstop:

“San Diego is not the only city pushing exorbitant tax hikes—LA County raised its rate not too long ago. Regulators have the industry trapped in a bubble; lower taxes and a tax-amnesty program are the only way to keep it from bursting.” – Virgel Grant, Founder & CEO, California Cannabis

Public-health advocates agree that affordability is key:

“State and local taxes on cannabis already top 33 percent. Higher taxes doesn’t necessarily mean more revenue—it means more inequity, more illicit sales, and less oversight.” – Shelby Huffaker, MPH, Americans for Safe Access—San Diego

Outlook

If AB 564 fails and the 19 percent excise rate takes effect, San Diego’s “stacked-tax” burden could be the highest of any major California market, eroding margins for compliant retailers already squeezed by falling wholesale prices and rising compliance overhead. Retailers contend that without relief—and soon—legal storefronts risk ceding more ground to a flourishing underground market.

As July approaches, all eyes are on Sacramento: Will lawmakers pause the excise-tax escalation, or will San Diego’s freshly minted 10 percent local levy be only the first domino in a new, costlier era for California cannabis?

Navy veteran JM Balbuena is an award-winning author, filmmaker, advocate, and entrepreneur committed to empowering aspiring leaders in the legal cannabis space. Her debut book, The Successful Canna-preneur, earned her “Cannabis Educator of the Year” (2021 Las Vegas Cannabis Awards) and inclusion in The New Latina’s “100 Latinas Shaping The World.” In June 2024, JM published Green Renaissance, exploring cannabis culture, history, and its potential for equity and economic growth, cementing her status as a thought leader in the industry. Find out more about JB Balbuena here.