If your roots run deep enough in California cannabis history, you know that 1996 was the year that the game changed, when Proposition 215 was passed laying the groundwork for what would go on to become the largest medical marijuana market on the planet and the epicenter for cannabis culture as we know it.

Authored by the legendary activist Denis Peron and his peers, Prop 215 was the first medical marijuana ballot initiative passed at the state level but it was the merger with Senate Bill 420 in 2003 that truly solidified the state’s legal position on the federally illegal cannabis plant.

Six years later, in 2009, the market had taken form and the popularity of online portals like Weedmaps gave Cali’s MMJ market a massive boost as cannabis consumers began to come out of the shadows looking to socialize with one another and normalize their passion for the plant. Despite the fact that new storefront dispensaries were popping up every day, it was not until July of 2009 that Oakland passed Measure F and became the first city not just in California, but anywhere in the U.S., to impose a tax on cannabis businesses located within city limits. That tax rate was a mere 1.8% and city officials hoped it would generate just under $300,000 in revenue for them the next year in 2010.

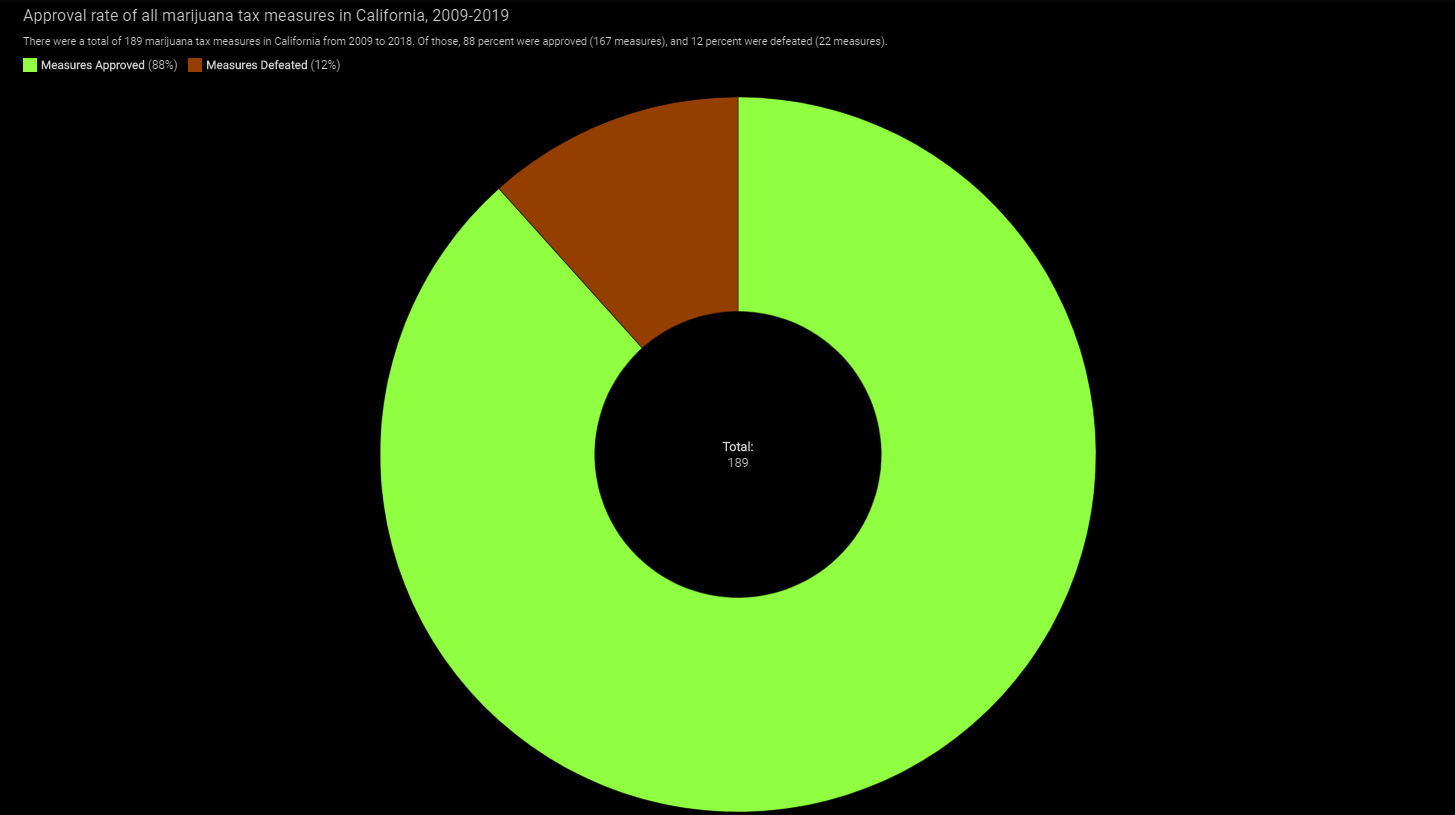

After Oakland blazed that trail, 188 more cannabis tax measures were passed in municipalities around California leading into 2018 when the sun set on Prop215/SB420 once and for all as Prop64 stumbled into place.

In fact, 88% of such measures that were proposed in that timeframe were successfully passed, proving that we’ve always been willing to contribute to society, as long as it’s a fair contribution.

Just because a city passed a measure allowing them to tax local cannabis-based businesses doesn’t mean that every cannabis-based business in that city decided to, or needed to, pay those taxes. Many were structured as non-profit entities and claimed tax exemption based on that status. Considering the all-cash nature of the cannabis business then and now, it is impossible to know exactly how much tax revenue should have been flowing from the Prop 215 market back to Sacramento but we do know that even today, the unregulated street market is estimated to be doing roughly $4 billion in annual sales. Take any fraction of that number and you’re talking about a massive amount of cash that came into California’s coffers in the decade leading up to recreational cannabis.

Here’s what we want to know… where’d it all go?

PROMISES MADE… PROMISES KEPT?

In those wild west days of medical marijuana in California, tax implementation and collection standards were all over the place – literally – and just like the growers, extractors, and sellers of weed in those days were not reporting shit to anyone for fear of federal repercussions, most marijuana-friendly municipalities were also silently trying to pocket as much cannabis cash as possible without inviting intervention from Big Brother.

As such, there were no press releases about cannabis revenues paying for a school’s campus renovation, or the construction of a new substance abuse facility. Why? Because that wasn’t happening. Of course, we do not know for sure but what must have amounted to millions of dollars over that ten-year timespan seems to have gone up in smoke. Most likely it was absorbed into general funds to be squandered by local politicians on their own pet projects, and some was also likely earmarked for law enforcement purposes.

That’s right, they were collecting taxes from cannabis businesses to bankroll future raids on those businesses. You think that’s shady? Well, they doubled down on that bullshit in Prop 64 and too many Cali voters happily went along with the flawed plan.

In the waning days running up to the November 2016 vote on Prop 64, all the Chads predicted we’d see a BILLION dollars in cannabis tax revenues coming back to the state by 2020 and industry watchdogs pondered how the state might spend that war chest. Well, here we are and the state will be lucky to hit a half a billion this year as it continues to limp through “legalization”.

We didn’t have to guess though, it was written right into the language of the proposed law. From the jump, anyone who bothered to read the proposition saw that the plan was to impose a 15% sales tax at the retail level on consumers. Additionally, growers would be subject to a $9.25 per ounce tax on marijuana flowers, and a $2.75 per ounce tax on cannabis leaves, at the wholesale level. Those taxes would be dispersed as follows:

Regulatory Costs

The first 4% of all revenue collected was to be apportioned for covering the costs of the various regulatory agencies overseeing the new marketplace including, but not limited to, the Bureau of Cannabis Control, the California Department of Fish and Wildlife, the Department of Food and Agriculture, etc.

It’s hard to argue with this line item, however, the fact that revenue has fallen so far short of expectations gives a good clue regarding the inefficiency of these agencies to date. The unbelievably slow licensure process throughout 2018 and into 2019 nearly caused an “extinction event” in the young industry as the state quite literally could not approve temporary licenses as fast as they were expiring due, allegedly, to a lack of staffing.

University Oversight

The next dump of funds would go to certain California universities, chosen by the state, that would each receive $10 million each year for 11 years to study the impact of legal marijuana on public health, public safety, marijuana market prices, and its statewide economic impact. Apparently, these recipients are also supposed to be researching whether additional protections are needed to prevent monopolistic business behaviors within the regulated cannabis industry. SPOILER ALERT: THEY ARE NEEDED. Still, none of this is meant to or will benefit the people that the taxes are being extracted from, and that is a common theme and a problem.

DUI Protocols

Here’s where we should have lit the torches and sharpened the pitchforks. We were told that our tax dollars would be given to the California Highway Patrol, as charity to keep them relevant in the cannabis discussion that was passing them by. The CHP was given the authority to reallocate those funds to third-party companies working to develop half-baked technology aimed at busting cannabis users with roadside DUI’s. Fuck that, man.

We’ve said it before and we’ll say it again, this issue right here is going to be the hill that cannabis prohibition dies on. Every other anti-weed argument and stupid ass stereotype have been shredded in recent years as the plant gains in popularity and mainstream appeal and so you can bet that their last talking point will be their loudest – that cannabis users make our roads unsafe. How we ever agreed to this is mind-boggling. (NOTE: We say “we” but don’t get it twisted, WE didn’t vote for this dumpster fire because WE read the damn proposition!)

Social Programs

Next, we were sold on the fact that the state would be dedicating $10 million dollars in the first year of legalization to local health departments and qualifying nonprofit organizations designed to help people find jobs as well as for the treatment of mental health disorders. Each year after year one, that total is supposed to increase by an additional $10 mill until 2022 when it will reach its cap of $50 million annually which is meant to be paid into perpetuity.

While not aimed directly back at the tax-paying cannabis community, this seems to be a legit use of taxpayer dollars and the overall positive impact on society aligns with the benign nature of the cannabis plant.

Medical Research

Also established with no expiration date, the state has vowed to contribute $2,000,000 each year to the University of California, San Diego and their Center for Medical Cannabis Research.

Most recently, the school was granted $3,000,000 which will be split between five tangential research projects that will research the effectiveness of the popular CBD cannabinoid to treat psychosis, rheumatoid arthritis, insomnia, alcohol dependence, and anorexia nervosa.

Considering the state’s deep-rooted history with medical marijuana, this makes sense, right?

Well, it would except that the scope of the research that the school is tasked with can vary greatly. In 2017, for example, the state gave the school $1.8M to try to develop a roadside test to bust drivers with cannabis in their system. This bullshit again?! We told you this is going to be their Little Big Horn.

General Fund

Any remaining funds after the above allocations were to be deposited into a general fund and then dispersed three ways into sub-trust accounts:

-

The Youth Education, Prevention, Early Intervention, and Treatment Account which exists to provide education to the state’s youth about substance abuse and how to avoid such a pitfall.

-

The Environment Restoration and Protection Account which was to be set aside to fund the cleanup of environmental damage caused by illicit cannabis cultivation. These funds are also earmarked to “discourage” illegal cultivation and we have definitely seen that come to life in the form of CAMP-style raids throughout last year with Blackhawk helicopters and National Guard troops chopping down grows from The Emerald Triangle in NorCal to the Anza Borrego Desert down south. Again, some of you voted for this whether you realized it or not.

-

The State and Local Government Law Enforcement Account which – you guessed it – gives even more money to Cali cops to find ways to apply DUI laws to cannabis consumers.

If you’ve been doing some rough math along the way, you probably realized that we’re nowhere near the billion dollars of spending money that the state was salivating over but the fact of the matter is that even if they did get their billion, that would represent less than 1% of the state’s annual budget.

We mention this because these taxes that are virtually inconsequential to the state of California are crippling the regulated cannabis market in the state along with the people who choose to participate in it – growers, manufacturers, retailers, and customers all suffer under this burden.

Knowing this, the state still chose to RAISE the cultivation and excise taxes recently, apparently in an attempt to close the gap between their phantom revenue expectations and reality. That increase will not even move the needle for the state’s spending cash, but will absolutely hurt the industry and will further incentivize customers to turn to the untaxed streets for their weed.

ALL ACCORDING TO PLAN…

It is important to note that the government looks at cannabis use, and the regulation of it, much differently than the average cannabis consumer does.

State and local governments tend to look at legal weed and make two main considerations when deciding how to tax it:

-

Revenue – Yes, they want to rake in that sweet, sweet cannabis cash.

-

Deterrence – Some commodities, like cigarettes and now (unfairly) cannabis, are deemed to potentially have harmful social or health effects. Governments use taxation as a way to control market pricing and influence consumer interest.

The way they see it, higher taxes equal higher prices which will deter “abuse” but policymakers must strike the right balance between reducing consumption and raising revenue. When they miss the mark, and prices/taxes go too high, they end up fueling the unregulated market as we are seeing happen here in Cali.

This artificial inflation of pricing to deter “abuse” that hasn’t been shown to exist is a foolish way to launch any industry, especially one with a well-established underground market. Sure, the suits in Sacramento want their billion bucks, but they seem to be missing the big picture. They can raise the taxes to 99% but 99% of zero is zero. Or maybe that’s the point. Perhaps they realized right away that it’s way too much work and there are far easier ways to milk a billion from Cali taxpayers. If they wanted to kill an entire industry in its crib, they’ve proven they know how to hold the pillow.

SHOW US THE MONEY

As mentioned previously, cannabis operators have shown a willingness to pay taxes in the past, but a far more fair and intelligent way of implementing such taxes would have been to start low and phase in higher rates as the fledgling market matured and licensed entities were fully up and running.

As far as we can tell, virtually none of the money extracted from the California cannabis market between 2009 and 2020 was allocated toward cannabis-positive initiatives. Instead they use that money to vilify cannabis users, figuratively and literally. Yes, last October the state awarded funds to 10 California cities with orders to use the money to fuel local social equity programs, but they only doled out $10 million total to be split up by the specified municipalities. Los Angeles got $3.5 mill out of that drip of cash and we see how wisely they spent that, right?

This shit is simple – as long as the state has even one weed dollar in their wallet and has yet to expunge EVERY SINGLE low-level cannabis crime from every resident’s record, they are the damn criminals.

For real though… Where are the press releases? No, not those, these…

The way we see it, they are taxing the plant just enough to keep the vast majority of the industry short of financial freedom and to keep prices just high enough that the prohibitionists still in power can hang their hat on the false pretense of “deterrence”. Meanwhile, state-sponsored gambling via the lottery is advertised and encouraged without a second thought of addiction or harm to society. They can do without our billion dollars a year as long as no potheads make a million dollars a year.