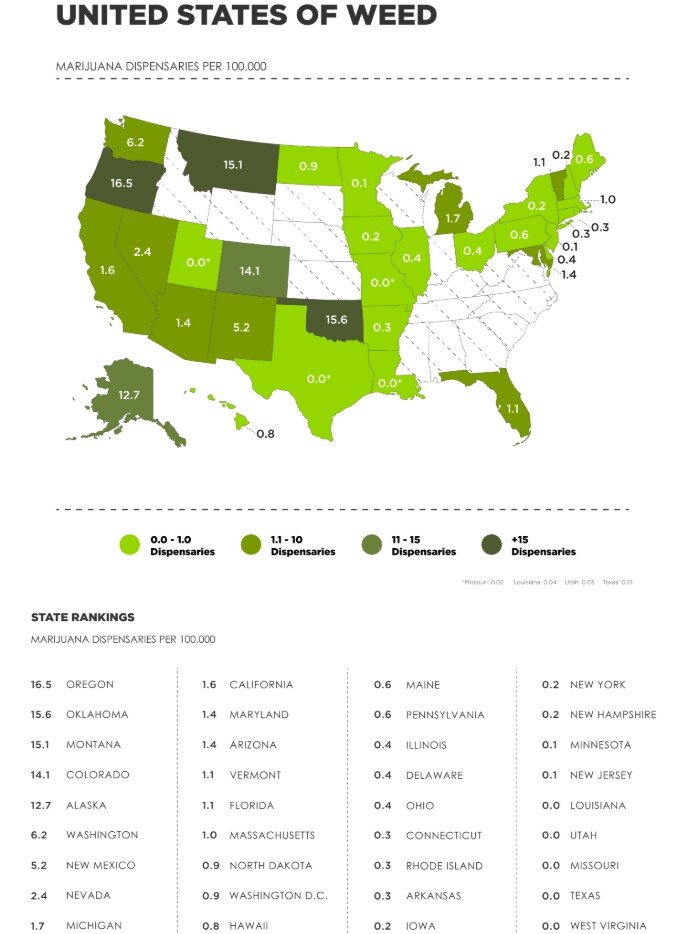

Operating a legal, licensed cannabis dispensary in California these days is no easy task. It isn’t cheap, either. A recent study conducted by multistate operator Verilife revealed that California has just 1.6 licensed dispensaries for every 100,000 residents. Compare that to Oregon (16.5:100k), or Oklahoma (15.6:100k) and it is plain to see that the process to open a legal weed shop here is an arduous one.

Source: Verilife

When consumers see how few of these stores there are, and then see the prices (and taxes) on the products being sold inside, it is easy to assume that Cali dispensaries are the only ones profiting at the end of an abused supply chain. The fact is, they shoulder enormous amounts of overhead in terms of real estate, labor, inventory, branding, and, of course, their vig to the powers that be at the local and state levels in the form of recurring permit and license fees as well as all those taxes you see stacked on the bottom of your receipt. On top of all that, the Feds hang them further out to dry like the rest of us in this industry with no banking, insurance, or tax rights.

Every one of these realities, and a thousand more we haven’t mentioned, chip away at whatever markup is placed on the wholesale price that these shops are paying for flower, concentrates, carts, edibles, and the rest of the products on their shelves leaving some slim profit margins.

You might be surprised to learn that the average grocery store in the U.S. operates on a minuscule 1-3% profit margin. Relying on large volume sales (like toilet paper, you damn savages), it is not uncommon for a supermarket to make just a few cents on individual items. To pad their earnings, most grocery stores employ something called “Slotting Fees” – a dollar amount charged to a brand in order to have their products placed in ideal locations in the store. That may be eye level on the shelf instead of at the bottom, or an endcap display, or a point of sale promotion. Like guacamole at Chipotle, that all costs extra.

Slotting fees, or paying for preferred product placement, is not a new concept nor is it exclusive to grocery stores. From Big 5 to Best Buy, there is a strategy for how the store is staged to encourage interaction between consumers and specific brands and many of the cannabis dispensaries here in California have embraced that strategy.

In the wake of COVID-19, our question is: How is that working out?

CAN I JUST HAVE SOME WEED… PLEASE?

As the spread of Coronavirus ramped up through March of this year, California Governor Gavin Newsom acted relatively fast to shut down vast swaths of commerce in the state, only leaving the lights on for what were to be deemed “essential” services such as grocery stores, pharmacies, gas stations, etc. The governor also listed the entire regulated cannabis supply chain as essential, allowing the crippled industry to keep limping along.

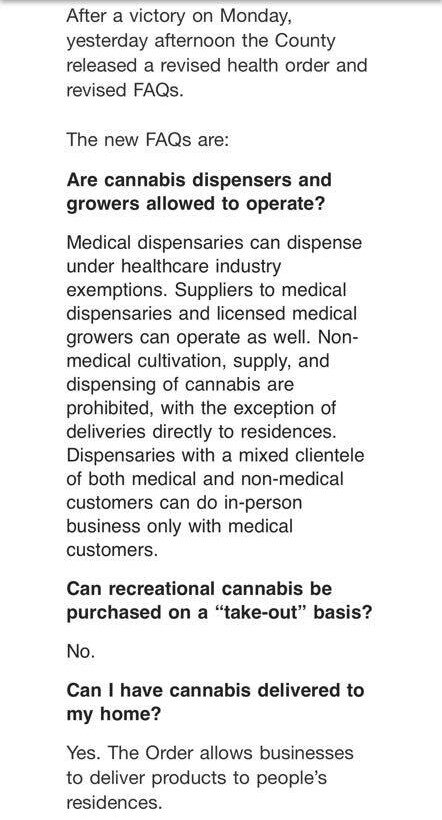

As with all things cannabis in Cali, however, local municipalities often have the final say when it comes to commercial cannabis activity within their jurisdiction. With a green light from the Bureau of Cannabis Control (BCC), many cities and counties began to allow for curbside pickup for pre-placed orders, allowing for proper physical distancing and sanitation protocols to keep everyone safe and traffic inside the store to a minimum.

As the threat of the virus intensified, the definition of “essential” has tightened and some local leaders are not willing to take a risk when it comes to weed. In Santa Clara County, cannabis advocates are fighting right now to restore an allowance for curbside pick-up after that right was rescinded county-wide last week, closing all recreational cannabis storefronts, leaving access only to delivery options, medically licensed dispensaries… or the streets.

What happens in Santa Clara County could have a ripple effect on the rest of the state. We are hopeful that, at the very least, they are able to restore curbside sales which have proven to be an efficient and preferred way for consumers to re-up their stash and for “essential” dispensaries to stay busy while staying safe.

It has us thinking that this form of cannabis sales is likely gaining in popularity for a lot of reasons, not the least of which being that most of us bought weed that way for a decade or more before we walked into our first dispensary.

Even once we finally kick COVID-19 to the curb, there is a strong possibility that once-taboo options like curbside pickup or drive-thru weed stores – along with home delivery – could become the new normal.

While there will likely continue to be “destination” dispensaries offering a weed buying “experience”, this quickly implemented model we are seeing during home sheltering is proving to move a LOT of weed with what could potentially be considerably less overhead.

For every customer that is impressed with multiple digital flatscreen menus or wants or needs to be educated by a budtender, there are 10 more that just want what they want as quickly and as affordably as possible. The continued success of the “traditional” street market is a testament to that.

ALL SALES FINAL

The other aspect of this potential new normal that keeps bouncing around in our brains is the Slotting Fee strategy. There are brands that have paid a considerable amount of money to have their products placed front and center, regardless of their quality or grassroots reputation.

How is that working out right now when custies never make it past the curb?

Authenticity is such a crucial and overlooked component in the success of any cannabis brand and it cannot simply be bought. The industry here in California was structured in a way that prioritized well-funded boofherding brands over self-sustaining legacy operators and too many top shelves reflected this imbalance in the introductory years of this market.

Whether it was an OG walking in and laughing out loud when a budtender tried to sell him or her some Ignite products, or whether it was one of the mythical new cannabis users coming in to try pot for the first time only to get a $75 hay-flavored headache, it was not and is not a good look to blindly promote the highest bidder.

Top Shelf used to mean something, and it can again.

As we all continue to fight for lower licensing fees and taxes in an effort to bring down prices for the consumer (while eking out a living for ourselves), we hope to see a simplification of the retail cannabis environment spring up as well. There are many ways they can shave down the barely sustainable overhead that they are burdened with now which, ideally, can put more money in their pockets while taking less out of their customers’ and can hopefully diminish their need for pay-to-play product placement, leaving the top shelf for the brands that have truly earned it.

Make your voice heard HERE to help STOP the rollback of consumer rights in Santa Clara County