Whether you grow indoors or outdoors, in “salt” or soil, the roots of your cannabis plants stretch downward because that is where they will find the water and nutrients that they need to optimize their health and growth. The plant’s roots serve another purpose, though, and just as crucial. They also provide support and stability to help anchor a plant to the ground. Without a strong root system, cannabis plants would not be able to stand strong and tall on their own.

Wouldn’t ya know it? All that shit is true for successful cannabis companies and operators as well.

In a rush toward vertical integration and market domination, most of the boof-herding corporations who paid to play the weed game without ever learning the old school rules neglected this fundamental lesson and, sure enough, they are starting to topple over in the turbulent cannabis industry.

As Ignite goes up in flames and MedMen swirls the drain, we turn our attention to High Times, or whatever is left of the once iconic brand. In November of 2018, we wrote an article titled High Times Bails Out Chalice Festival But Who Will Bail Out High Times?

If you recall, the SoCal-based hash, glass & music fest was canceled at the 11th hour that year when event organizers failed to gain local approval. Countless vendors and pre-sale ticket holders were left empty-handed as initial promises of refunds went up in smoke almost immediately.

THE HEAVILY LEVERAGED BUCK STOPS… WELL… SOMEWHERE

Facing a reported half million dollar debt, Chalice was scooped up by High Times, a key rival in the cannabis event industry. To this day, Doug Dracup the founder of Chalice Festival claims that his intention was to clean up the mess created by the event cancellation in 2018, but that High Times took that obligation off his hands with their acquisition.

This might be the way that big businesses operate in other industries, but the whole thing stunk to the vast majority of the cannabis community, particularly here in Cali.

However, it was just the beginning of a series of questionable acquisitions and mergers that High Times has cobbled together in the past two years, often using phantom stock options as bait to lure in fresh meat.

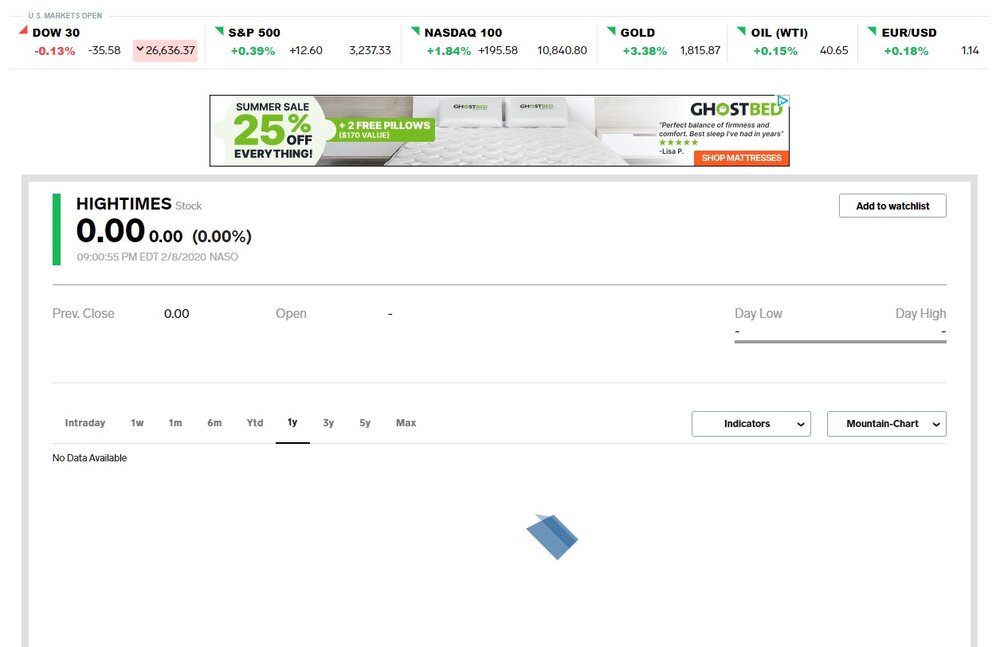

The company’s parent corporation, High Times Holding Corp (as in, allegedly Holding your Chalice refund, fam), launched what is called a mini-IPO, allowing them to raise up to $50 million in an attempt to take the company public and offer legit stock options.

This sort of mini-IPO is most commonly used by startups looking to turn a loyal customer or fanbase into investors. In the case of High Times, the sales pitch was that for a minimum investment of $99, anybody in the general public could buy-in early, then reap long term rewards as their shares exploded in value once High Times officially hit the stock exchange.

The road to Wall Street has been a long, twisted, uphill slog for High Times and whoever answered their YouTube ads for investment capital, the latest roadblock being a public smackdown from the Securities and Exchange Commission (SEC).

HURRY UP & WAIT SOME MORE

Apparently, High Times failed to meet an extended deadline to file properly audited financial reports for 2019 and as of last month, has been forced to stop accepting new investors into its IPO. The powers that be at High Times have pushed back against news outlets reporting on the story, saying that they have followed all of the SEC’s guidelines and that this is just (another) temporary setback. The company is still soliciting investors on its website, apparently, it just cannot close those transactions until they get right with the government.

Since launching the IPO in 2018, the company has blazed through three different CEOs while also fumbling its Cannabis Cup events to the point of becoming a punchline, all as the death of print journalism drags the brand’s original legacy down with it.

Whether you are savvy with the stock market or the owner of a cannabis company considering buy-out offers, does any of the above inspire confidence?

When High Times buys your brand in exchange for shares in theirs, what exactly are you left with?

This is not a new trend, and it is certainly not unique to cannabis. In 1988, 60% of large business acquisition deals were paid for in full with cash, just 2% involved stock options. Ten years later, in ’98, roughly 50% of those deals were paid for with stocks and just 17% with cash. These days, that disparity is even greater.

According to the Harvard Business Review, “In studies covering more than 1,200 major deals, researchers have consistently found that, at the time of announcement, shareholders of acquiring companies fare worse in stock transactions than they do in cash transactions.”

But High Times doesn’t want to pay cash… even if they had any. In the six months beginning this year, ending on June 30th, the company had amassed a budget deficit of over $105 million.

High Times Executive Chairman Adam Levin sees no problem with that dent, saying in a recent press release, “The listing of the company’s stock will give us a trading currency that will assist us in furthering our acquisitional goals. With the lessons we’ve learned from other operator’s mistakes, great management, and the current state of the industry, now is the time for High Times to thrive!”

In fact, the company announced a new acquisition the same day they reported that massive deficit.

Levin – who once owned Girls Gone Wild and Penthouse – still vows to make High Times a “Billion-dollar brand”.

The SEC, on the other hand, has expressed “significant doubt” that the company will be able to tread water financially for another year at its current burn rate due to “recurring operating losses, net operating cash flow deficits, and an accumulated deficit”.

Who to believe?

The next chapter may be the last for High Times as they appear to be going all-in on cannabis retail sales, banking on the strength of their name to rise to the top of the regulated market in California.

Getting to the top of this market, as it is currently set up, typically costs way more money than it makes with the idea that someday down the road it will become profitable. High Times does have plenty of experience in that sort of upside-down bookkeeping, but how long can that last?

You can INVEST IN OUR PATREON PAGE HERE to support grassroots media with a guaranteed return of raw, unfiltered cannabis news, views & culture preservation every week from our crew. If you can afford an extra cup of coffee each month, buy one for the Bros!