This is Part 1 of a three-part series of articles on the current state of THC potency inflation. Look for Parts 2 & 3 shortly here at Beard Bros Pharms!

California – On October 5, 2021, Governor Gavin Newsom signed California Senate Bill 544 into law. Among other things, it impelled the California Department of Cannabis Control (DCC) to create a standardized test method for the analysis of cannabinoids in cannabis samples for official compliance testing (the test that validates whether a product is free of harmful contaminants and is labeled properly). The chief reason for this mandate was to try to curb an inexorable march of increasing THC test results being put out by the state-licensed testing labs.

Why have the labs been releasing inflated THC results? For the uninitiated, here’s a primer: in order for any cannabis product to be put on dispensary shelves, it has to be tested by a state-licensed cannabis testing lab, and the testing lab’s numbers have to match the labeled amounts for that product in order to release that product for sale. Testing labs were meant to be an independent third-party check on the producers of said product. However, while the rules require that the producer and lab must not be owned by the same party, labs are still hired by the producers to perform these tests.

Therefore, there is a direct financial incentive for the labs to produce results favorable to the cultivator or manufacturer rather than representing a number accurately. This incentive is no more acute than with THC, which is often the primary price factor for dispensaries purchasing the product. So often, one of two things will happen: a producer and a lab will come to an agreement about the THC number they want to label it, and they will label the product with that number and the lab will match it with their test, or the producer goes to a lab that they know produces high numbers across the board, and will label the product with whatever number the lab provides.

Of course, as soon as these numbers became detached from reality, the numbers kept creeping up. If 20% Total THC flower didn’t mean as much as it used to, producers wanted higher numbers to stand out. So that desired THC number became 25%. Then 30%. Then 35%. While some bold labs/producers bumped their numbers into the 40s, even the average THC numbers climbed north of 30%, when all along, everyone knew the average THC% in flower on the shelves is really in the low 20s.

So in 2022, the Department of Cannabis Control worked on and released a standardized cannabinoid test method, which went through several rounds of public comment and editing and ended up being limited to the testing of flower and non-infused pre-rolls. That same year, we released an article detailing the then-current state of THC testing in the industry, and the results were pretty staggering: 87% of the ~150 off-the-shelf samples had labeled THC values >10% above the actual result, and around half were greater than 20% off.

In 2023, inflated THC results continued to persist, despite warnings from the DCC later in the year that labs could face consequences for inaccurately representing potency. For example, here are a handful of results from products off the shelf that were packaged and tested in late 2023 that we tested using the new DCC method:

| Tested Pre-01/01/2024 | ||||

| Type | Label Claim Total THC | Tested Total THC | Percent Off Label Claim | Percent Inflation |

| Flower | 32.0 | 21.75 | 32.09% | 47.26% |

| Flower | 34.4 | 24.36 | 29.22% | 41.28% |

| Flower | 35.9 | 28.12 | 21.71% | 27.73% |

| Flower | 33.4 | 24.13 | 27.80% | 38.51% |

| Flower | 28.3 | 17.58 | 37.77% | 60.70% |

| Flower | 28.9 | 20.39 | 29.48% | 41.80% |

| Average: | 32.16% | 22.72% | 29.68% | 42.88% |

Our average tested value for these samples was 22.7%, while the average labeled value was 32.2%. We were seeing an average inflation of nearly 43% of THC values on these samples. To be clear, what that means to the consumer is that they are being told that 40% more THC is in their flower than is actually present.

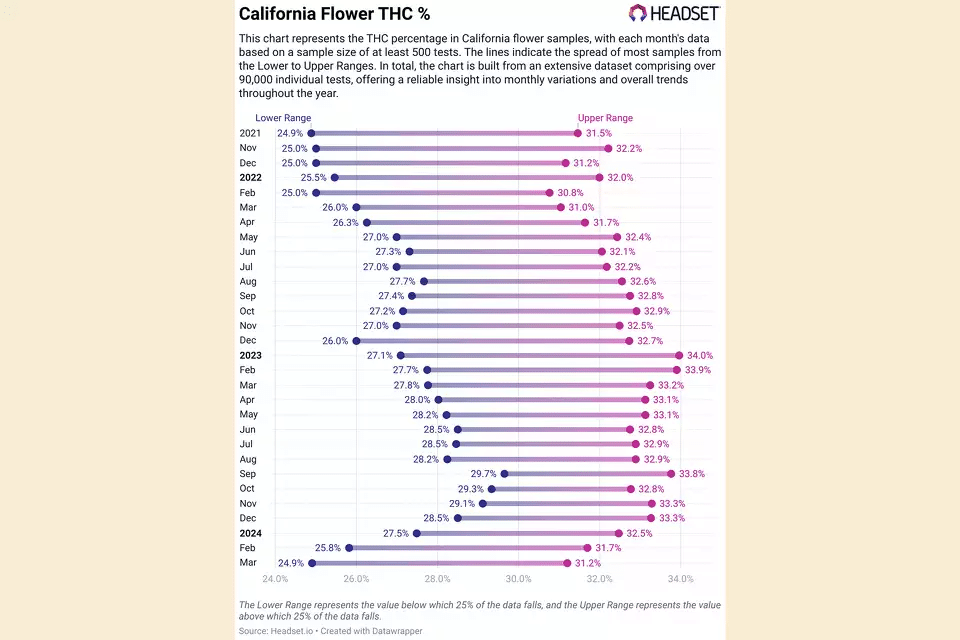

The DCC’s new standardized method was set to take effect January 1st, 2024, so all new flower packaged after that date would be subject to the new testing rules. As can be seen in the data below (produced by Headset and first reported by SFGate), average THC percentages did noticeably dip compared to their historical averages (although the average results were still higher than the true average potencies; note the bottom of the range in March 2024 is still higher than our tested average above).

Unfortunately, it appears that the impact of the implementation of the standardized method on the inflation of THC percentages did not last long. The results seen below are from real, off-the-shelf samples provided to us, packaged and tested this year using the DCC standardized method:

| Tested Post-01/01/2024 | ||||

| Type | Label Claim Total THC | Tested Total THC | Percent Off Label Claim | Percent Inflation |

| Flower | 21.3 | 15.21 | 28.65% | 40.15% |

| Flower | 22.0 | 15.41 | 29.94% | 42.74% |

| Flower | 33.9 | 21.92 | 35.38% | 54.76% |

| Flower | 34.3 | 17.58 | 48.75% | 95.14% |

| Flower | 30.6 | 20.13 | 34.14% | 51.85% |

| Flower | 26.6 | 17.27 | 35.14% | 54.18% |

| Flower | 32.5 | 23.04 | 29.05% | 40.95% |

| Flower | 31.1 | 21.31 | 31.40% | 45.77% |

| Flower | 34.4 | 21.25 | 38.27% | 62.00% |

| Flower | 21.7 | 15.64 | 27.79% | 38.49% |

| Flower | 35.3 | 19.98 | 43.41% | 76.70% |

| Flower | 22.8 | 14.70 | 35.43% | 54.86% |

| Flower | 24.2 | 20.11 | 17.05% | 20.56% |

| Flower | 30.0 | 20.61 | 31.39% | 45.75% |

| Flower | 38.9 | 27.15 | 30.14% | 43.15% |

| Flower | 33.0 | 30.09 | 8.84% | 9.70% |

| Flower | 32.8 | 23.48 | 28.37% | 39.61% |

| Flower | 24.1 | 19.27 | 19.99% | 24.98% |

| Flower | 30.1 | 21.35 | 29.14% | 41.12% |

| Flower | 31.5 | 29.36 | 6.78% | 7.27% |

| Flower | 30.2 | 27.29 | 9.75% | 10.81% |

| Flower | 35.0 | 27.76 | 20.58% | 25.91% |

| Flower | 27.0 | 24.21 | 10.47% | 11.70% |

| Flower | 25.1 | 18.61 | 25.93% | 35.00% |

| Flower | 30.1 | 19.86 | 34.12% | 51.79% |

| Flower | 32.5 | 23.72 | 26.96% | 36.90% |

| Flower | 30.8 | 22.59 | 26.63% | 36.30% |

| Flower | 32.7 | 25.49 | 21.97% | 28.16% |

| Flower | 29.0 | 21.56 | 25.61% | 34.43% |

| Flower | 38.7 | 27.47 | 28.96% | 40.77% |

| Flower | 35.3 | 24.09 | 31.77% | 46.56% |

| Flower | 35.8 | 28.31 | 20.93% | 26.46% |

| Flower | 30.1 | 24.37 | 19.13% | 23.66% |

| Flower | 29.0 | 22.38 | 22.76% | 29.47% |

| Average: | 30.36% | 22.13% | 26.90% | 39.05% |

Even if there was a temporary dip in reported THC concentration, labs seem to have already gotten comfortable with the thought that the DCC will not take action. Of the 34 flower samples tested, there was an average labeled value of 30.4%, while our average tested result was 22.1%. The average inflation of 39% is essentially exactly in line with the numbers we were seeing before this method went into effect.

We also tested some non-infused pre-rolls packaged after the new rules went into effect, and we can see even more pronounced inflation:

| Tested Post 1/1/2024 | ||||

| Type | Label ClaimTotal THC | TestedTotal THC | Percent OffLabel Claim | Percent Inflation |

| Preroll | 21.7% | 15.1% | 30.4% | 43.6% |

| Preroll | 27.9% | 15.0% | 46.5% | 86.7% |

| Preroll | 29.7% | 18.0% | 39.3% | 64.8% |

| Preroll | 28.3% | 17.0% | 39.8% | 66.2% |

| Preroll | 26.1% | 12.3% | 52.7% | 111.5% |

| Preroll | 25.3% | 17.3% | 31.5% | 46.0% |

| Preroll | 20.1% | 15.9% | 20.9% | 26.5% |

| Average | 25.6% | 15.8% | 37.3% | 63.6% |

The pre-rolls had an average label claim of 26%, while our average tested result was 16% for the 7 different prerolls, which came out to an average inflation of 64%, with one pre-roll’s label claim more than double the tested result.

How is THC potency inflation right back to where it was before the standardized method was implemented? Wasn’t the standardized method supposed to solve the problem? More pointedly, maybe the right question is, was the problem with the labs’ methods in the first place, or is there something else going on? We will explore this in Part 2, so keep your eyes peeled!

About The Authors

Josh Swider is the founder and CEO at Infinite Chemical Analysis Labs his passion for analytical chemistry and consumer safety he has made his mission ensure only safe; quality cannabis products are allowed to be sold to consumers.

Erik Paulson is the Lab Director for Infinite Chemical Analysis Labs in San Diego, California. As a former high school educator turned analytical chemist, he has a passion for educating both cannabis industry professionals and consumers on the ethical challenges the cannabis industry faces.