SAVE THE DATE: ****AUGUST 29, 10:00AM***

Calling all CANNABIS OPERATORS – AND ACTIVISTS

STOP CALIFORNIA’S CANNABIS EXCISE TAX GRAB!

STAND WITH CATALYST AND ALL of CALIFORNIA CANNABIS INDUSTRY

AT 10AM ON AUGUST 29th

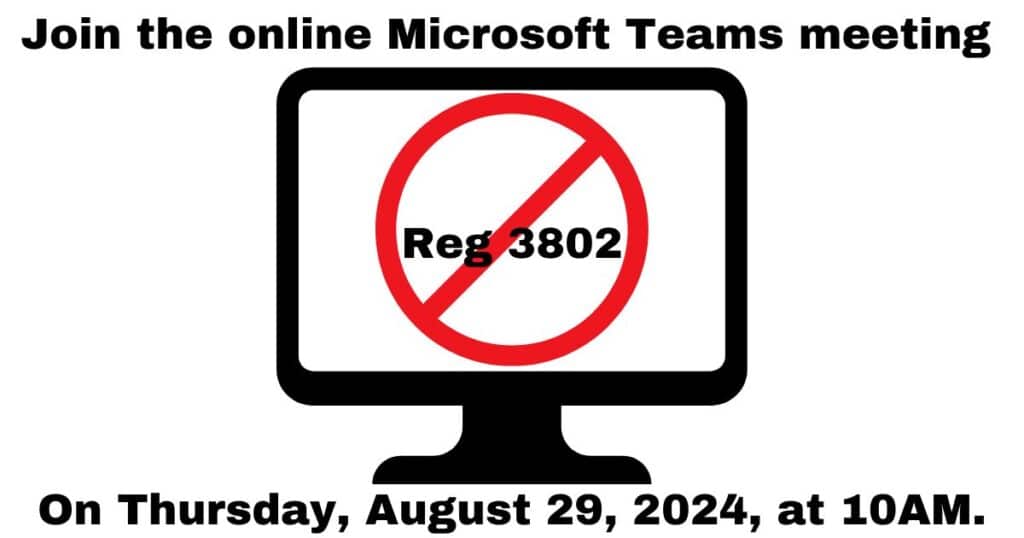

AND PROTEST REG 3802!

The CDTFA is set to make permanent Emergency Regulation 3802, forcing cannabis retailers to charge excise tax on optional tangible personal property (accessories component of vape – for example) and costing businesses and their customers potentially hundreds of millions of dollars in additional excise taxes.

This regulation opposes the will of the people as stated in Prop 64 and Regulation 3700, which has always allowed retailers to separate accessories from cannabis oil on their receipts, only charging customers excise tax on the cannabis oil. Reg. 3802 was rushed into law in October 2023 without even proper public input or participation.

This is an overreach of government and taxing authority of CDTFA. Please join us in a show of force and numbers. Goal is to have A THOUSAND OR MORE attend.

HNHPC, Inc., parent company of Catalyst Cannabis Company, along with owner CEO Elliot Lewis, have filed suit to fight the CDTFA and the Office of Administrative Law, which are attempting to ramrod Reg. 3802 into effect as permanent tax code. We need to stand with them by joining the online Microsoft Teams meeting on Thursday, August 29, 2024, at 10AM.

Right now, California’s cannabis taxes are some of the highest in the nation. California also collected more cannabis taxes in than any other state in 2023. If Reg. 3802 can be rolled back, it will go a long way to making cannabis taxes more reasonable and give our legal cannabis industry a fighting chance to be competitive during these difficult times!

You may join the meeting on your computer or mobile app through Microsoft Teams or by calling 1-916-5350987 and then entering the phone conference identification number 365 922 32#.