For an industry generating billions in revenue, cannabis still operates like it’s stuck in a pre-digital era. Every day, dispensaries across the country handle mountains of cash because most banks and card processors refuse to work with them.

That cash dependency isn’t just inconvenient, it’s dangerous. It puts customers, employees, and entire businesses at risk while bogging down operations with accounting headaches and security concerns.

The industry’s innovators knew this wasn’t sustainable. What cannabis needed wasn’t another “workaround.” It needed a true financial solution built for transparency, safety, and scalability. That vision became Cannatrac®️, and the product of that vision is the CannaCard®.

The Founder’s Story: From Insight to Innovation

The journey of Cannatrac began not with an invention, but with a deep understanding of a systemic failure. The year was 2009, and the legal cannabis movement was gaining traction, but the entire ecosystem was being throttled by one core problem: banking.

The Seed of an Idea (2009–2012)

Cannatrac’s founder, Terry Patton, attended a three-day seminar in Ann Arbor, Michigan, in May 2009, focused on the emerging risks and rewards of legal cannabis. That experience sparked a relentless pursuit of knowledge that would last for years.

From attending the Marijuana Policy Project’s 15th anniversary in Washington, D.C., to organizing the “Cannabis Compassionate Care and Science Seminar” in Kalamazoo, the mission became clear: Understand the cannabis industry from the ground up.

This wasn’t a theoretical exercise. Patton immersed himself in the science, sociology, and economics of the plant, attending the International Cannabinoid Research Society Symposium, connecting with over 250 global researchers, and traveling across Colorado with one of the few remaining federally approved medical marijuana patients.

The takeaway was unmistakable: the industry’s dependence on cash wasn’t just inefficient. It was unsafe, unsustainable, and holding the entire sector back.

The Pivot to Purpose (2012–2014)

With a strong background in financial services, Patton recognized that the solution had to address compliance first and foremost. The opportunity wasn’t just about convenience; it was about creating a financial system that could meet the letter of both federal and state mandates.

This period became a boots-on-the-ground education. Patton met with law enforcement, regulators, community leaders, and business owners. The insight was unanimous: without a compliant, secure cashless payment solution, the legal cannabis market would remain vulnerable, both to crime and to criticism.

That’s when purpose became mission. The goal shifted from studying the problem to engineering a fix. A system that could process payments safely, transparently, and within the law.

Building Cannatrac: From Blueprint to Platform (2014–Present)

By 2014, Colorado had become the epicenter of adult-use legalization and the perfect testing ground for what would become CannaCard®.

Patton and his team focused on building a closed-loop payment platform designed for total transparency and public safety. Extensive collaboration with state regulators, legislators, and financial experts followed, culminating in Cannatrac delivering a groundbreaking White Paper to Colorado officials in September 2015. That document outlined the framework for a compliant, cashless cannabis payment system that met federal banking expectations while increasing safety for consumers and businesses alike.

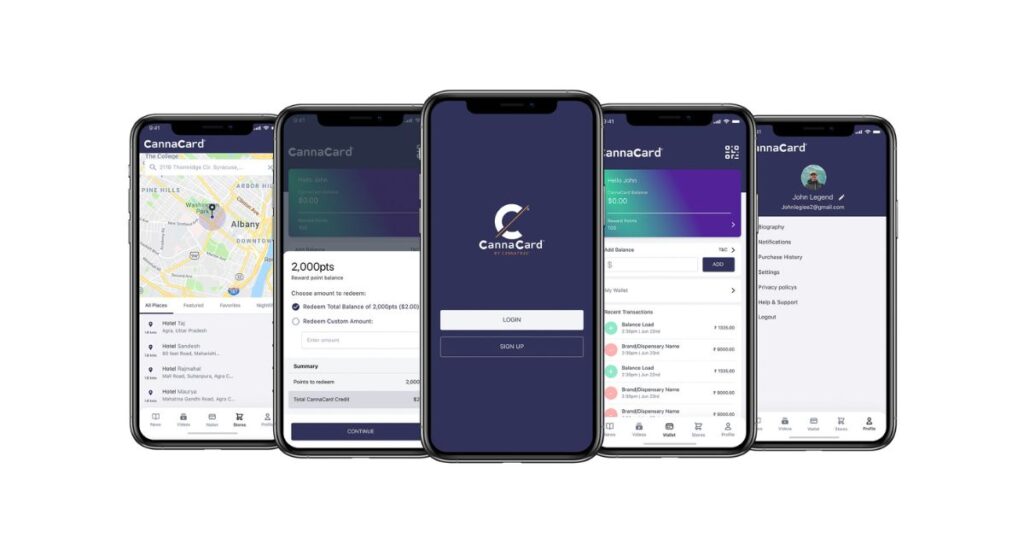

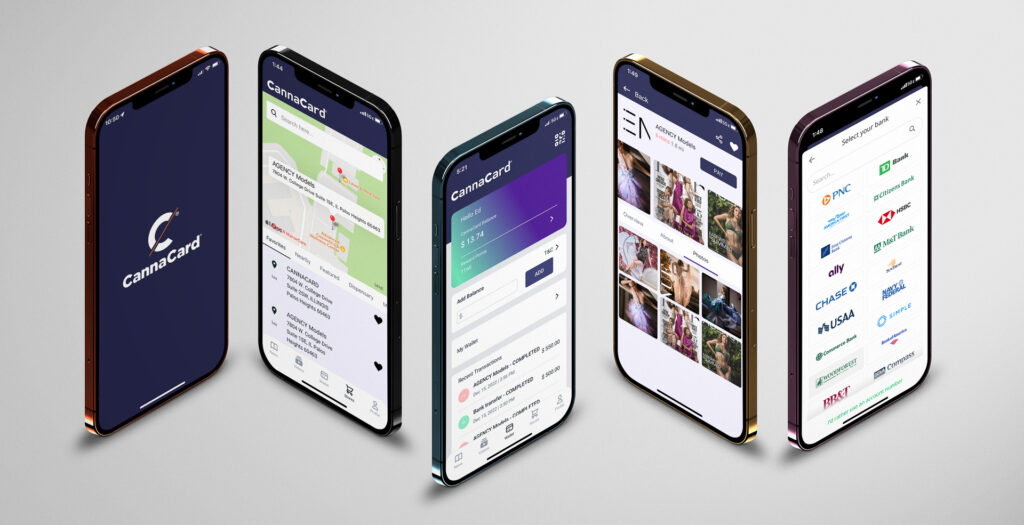

A nine-month sprint followed in California to design the CannaCard and its companion CannaCard Mobile App. The technology was built to address every issue identified during years of research from regulatory reporting to tax compliance and security.

In September 2015, the platform was presented to California’s Board of Equalization delegation during their Colorado fact-finding mission. It was clear: the cannabis industry finally had a viable financial solution.

Between 2015 and 2016, Cannatrac assembled a world-class management team of banking, compliance, and technology experts. Their mission was to ensure CannaCard would launch not as a workaround but as a legitimate, scalable infrastructure for the entire cannabis economy.

The Global Brand: Building CannaCard’s Worldwide Footprint

From day one, Patton’s vision for Cannatrac wasn’t limited to a single market or state. He saw a global problem that demanded a global solution.

At the company’s earliest stage, trademark filings were prepared in the most grassroots way possible at Patton’s parents’ dining room table. That effort resulted in CannaCard securing registered trademarks across the majority of 50 U.S. states, followed by Federal and international filings that now cover 58 countries and territories worldwide.

This global legal foundation gave Cannatrac the strength to protect and scale its innovation as cannabis markets opened across borders.

In 2022, Cannatrac was recognized for its leadership in fintech and cannabis compliance when Patton was invited to Chicago’s 1871 Fintech Incubator for the inaugural launch of the Cannabis Fintech Innovation Hub, a milestone that positioned CannaCard as a bridge between cannabis and mainstream finance.

Today, CannaCard stands as a global leader in compliant, cashless payments — a proven, secure, and legal solution for an industry that’s long been left behind.

Secure Payments for an Industry on the Move

At its core, CannaCard® is a secure, closed-loop cashless payment system built for transparency, safety, and ease of use. Every transaction is tracked, secure, and compliant. But what makes CannaCard® even more compelling is what it gives back.

Every dollar spent earns reward points that can be redeemed for exclusive offers, merchandise, or discounts. Users save on costly ATM fees while enjoying a faster, safer way to pay. And because funds are preloaded, consumers can shop confidently knowing they’re using a compliant, regulated system that protects their privacy and their wallet.

For Businesses: From Payment Processor to Growth Partner

CannaCard® isn’t just a payment solution; it’s a business engine.

Dispensaries and retailers accepting CannaCard benefit from the platform’s built-in marketing and analytics tools. Through push notifications, in-app advertising, and geo-fencing, businesses can target local customers with offers in real time.

Imagine sending a special promotion to users attending a concert, sporting event, or cannabis expo, reaching them right when they’re most ready to spend. That’s the power of the CannaCard ecosystem.

The Merchant Dashboard allows businesses to track customer purchases, manage account balances, and monitor performance all in one place.

CannaCard helps retailers stand out in a crowded market, increase repeat visits, and drive measurable growth through smarter, data-informed engagement.

Why the Cannabis Industry Needed CannaCard Yesterday

Since legalization began, the cannabis sector has faced the same recurring problem. Access to safe, compliant banking.

For years, operators have relied on cash-heavy models, gray-area processors, or fintech stopgaps that ultimately couldn’t meet the industry’s regulatory demands. This approach isn’t just inefficient, it’s unsustainable.

CannaCard® represents the evolution of cannabis commerce. It provides the compliance, transparency, and user experience needed to take the industry from survival to success.

By aligning with banking protocols and ensuring every dollar is accounted for, CannaCard® doesn’t just make cannabis safer, it makes it legitimate.

Data That Builds Trust and Community

Through its integrated dashboard and reporting systems, CannaCard® provides businesses with the kind of insight previously only available to mainstream retailers. It’s not about surveillance; it’s about sustainability.

Operators can identify spending trends, reward loyal customers, and understand where their marketing efforts actually drive results. That kind of data transparency helps elevate cannabis from the shadows of cash to the standards of modern commerce.

It’s not just a financial upgrade, it’s a cultural one.

Marketing That Moves With the Consumer

CannaCard®’s geo-fencing and in-app advertising tools empower retailers to engage customers where they already are. Whether it’s before a concert, during a festival, or near a competitor’s store, businesses can send timely, relevant offers that drive traffic and build relationships.

This isn’t theory. It’s actionable technology that puts small and mid-sized operators on equal footing with national brands. In a market where attention is currency, CannaCard gives retailers the power to earn it.

A Platform Built for Progress

As legalization continues to expand, one thing remains clear: the future of cannabis commerce depends on secure, compliant, cashless payment systems.

CannaCard® isn’t a workaround; it’s the infrastructure cannabis has been waiting for. It delivers what both regulators and consumers have been demanding in terms of transparency, accountability, and trust.

By merging financial integrity with customer experience, CannaCard® proves that innovation in cannabis doesn’t mean cutting corners. It means raising the standard.

The Road Ahead

Cannatrac’s journey from a seminar in 2009 to a global fintech leader is proof that the hardest problems create the biggest opportunities.

What started as a response to a safety and compliance crisis has grown into a global platform serving both cannabis consumers and businesses with integrity and innovation.

Today, CannaCard® continues to expand its reach by connecting dispensaries, brands, and customers under one simple promise:

Shop. Pay. Earn Rewards.®

Because cannabis deserves a payment system as modern and legitimate as the industry itself.Are you a dispensary, delivery service or brand interested in utilizing CannaCard for payment? Please reach out to schedule a demo or contact CannaCard for more information.

- Normalization of Cannabis Continues with New Updates to iPhone Health App

- Cannabis Payment Processor Closes, Files Suit Against Vendor

- B2B Cannabis Show Highlights the Role of Payments in the Cannabis Industry

- Whitney Economics Report Indicates Cannabis Operators Topped $3.8 Billion In Delinquent Payments In 2023

- 2025 – Upcoming Income Tax Deadlines: Key Dates To Know