For an industry that prides itself on innovation, cannabis has spent too many years stuck with outdated, unsafe and unsustainable financial systems. Before legal markets matured, operators were hauling duffel bags of cash to tax offices and storing payroll in back rooms like a 1980s movie plot.

It was dangerous, inefficient and a giant neon sign advertising just how underserved the legal market really was.

Safe Harbor Financial changed that. And now, a decade after launching the first fully compliant cannabis banking program in the United States, they are expanding into something much bigger: the industry’s first complete financial solutions platform.

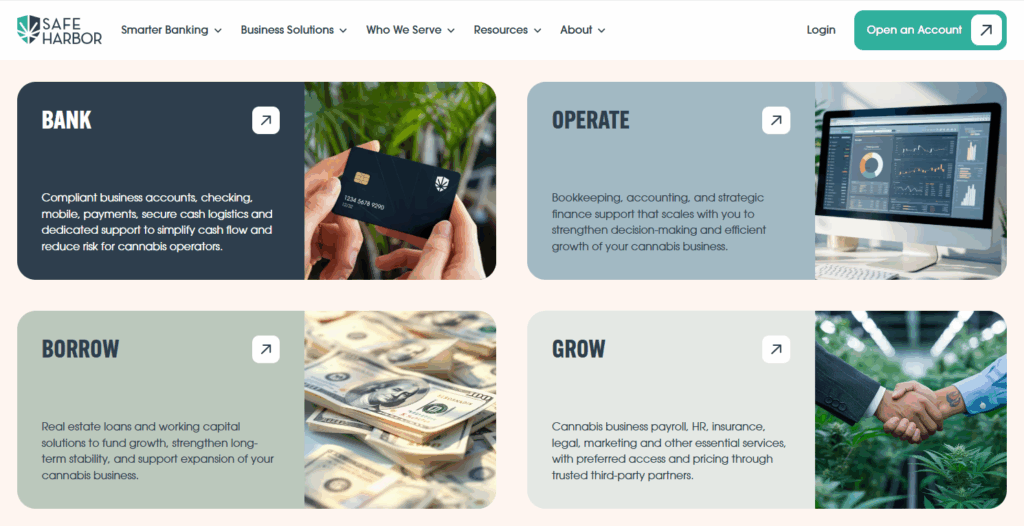

BANK. BORROW. OPERATE. GROW.

Four words that reflect ten years of evolution and one clear reality: cannabis operators deserve financial infrastructure that works as hard as they do.

The Early Days – When Banking Alone Was a Revolution

When Safe Harbor launched in 2015, banking alone was enough to shock the system. No one else had done it. No one else was even close. Banks avoided cannabis entirely. Regulators were uneasy. Operators were left improvising their way through multi-million-dollar cash operations.

Safe Harbor, led by founder Sundie Seefried, built a legitimate, regulator-approved banking model from scratch. Not a loophole. Not a workaround. A compliant program developed hand-in-hand with auditors, state agencies and federal partners who needed to understand how legal cannabis could integrate into the U.S. financial system.

That foundation reshaped the industry. It normalized cannabis banking, pushed regulators to evolve and showed financial institutions nationwide that legitimate cannabis operators could be served safely.

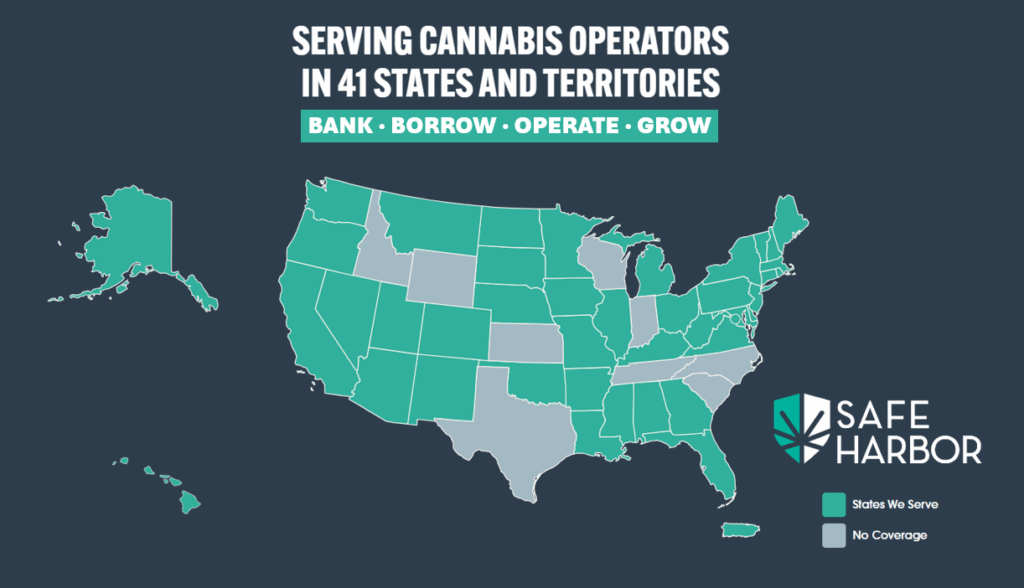

Ten years later, the impact is undeniable: more than $26 billion in cannabis-related transactions processed across 41 states and territories.

Two Years Ago – Safe Harbor Adds Lending and Expands Access to Capital

Once Safe Harbor stabilized banking for operators nationwide, another obstacle quickly emerged: capital. Legal operators needed growth funding but were met with sky-high interest rates, predatory terms and lenders who treated cannabis like a liability instead of a business sector.

Two years ago, Safe Harbor addressed that gap by launching Borrow, a lending program designed for established cannabis operators. Their model brought something rare to the sector: consistency, transparency and a lender that actually understood the financial realities of the cannabis supply chain.

Today, Safe Harbor is going further by helping financial institutions resell cannabis-related loans and better manage portfolio risk. That alone opens up more capital flow into the sector, which the industry desperately needs.

2025 – Safe Harbor Unveils the First Complete Financial Solutions Platform

In November 2025, Safe Harbor announced the launch of the cannabis industry’s first comprehensive financial solutions platform. This evolution is built around four pillars: bank, borrow, operate and grow.

This shift represents a decade of learning exactly where cannabis operators struggle most and building infrastructure to fix those gaps at scale.

Here is what the new platform delivers.

BANK – The Foundation That Started It All

Safe Harbor continues to operate the most experienced, compliant and transparent cannabis banking program in the country. Services now include:

- Secure accounts

- Digital access tools

- Cash logistics coordination

- Payment support

- Audit-ready reporting

- Compliance-driven financial monitoring

Banking is no longer the end of the story. It is the foundation.

BORROW – Capital That Actually Works for Cannabis

Safe Harbor has expanded its lending program to include more flexible options for established operators across multiple markets. Their capital solutions are designed around the realities of legal cannabis, not the fears of traditional finance.

Their lending program now supports:

- Term loans for expansion

- Working capital

- Refinancing existing debt

- Portfolio risk management for financial institutions

- Resale channels for cannabis-backed loans

This is a meaningful unlock for an industry still battling limited access to capital.

OPERATE – The Missing Piece Operators Have Needed for Years

This is where Safe Harbor’s platform shows its true strength. The company has launched a suite of operational and financial support services built specifically for the day-to-day realities of cannabis businesses.

Their Operate suite includes:

- Bookkeeping

- Payroll

- Accounts payable and receivable

- Reporting

- Cash management

- Collections

- Merchant services

- HR support

- Insurance solutions

- Logistics solutions

- Cannabis-specific operational tools

For years, cannabis operators had to cobble together these services from vendors who barely understood the regulatory environment. Safe Harbor has centralized them under one umbrella with cannabis-experienced professionals driving every function.

GROW – Strategic Finance for Operators Preparing for the Next Era

The Grow suite tackles the more advanced financial needs operators face as markets mature and consolidation increases:

- Fractional CFO support

- 280E guidance

- Forecasting and budgeting

- Valuations

- Investor preparation

- Multi-entity structuring

- M&A support

Whether an operator is preparing to scale, raise capital or sell, Safe Harbor now provides the financial clarity needed to negotiate confidently and avoid costly mistakes.

Together: A Full-Service Financial Infrastructure Built Exclusively for Cannabis

With Bank, Borrow, Operate, and Grow now under one brand, Safe Harbor has positioned itself as the closest thing cannabis has ever had to a complete financial backbone.

Operators can:

- Strengthen their internal finance teams

- Outsource entire operational functions

- Fill specific gaps

- Prepare for expansion

- Ready themselves for acquisition

The platform offers flexible, specialized end-to-end support at a cost far lower than hiring a full internal financial department.

Leadership and Momentum Heading Into 2026

Under CEO Terry Mendez, Safe Harbor has undergone a strategic transformation. The company:

- Restructured its board

- Expanded its senior leadership team

- Launched new financial products

- Secured additional capital

- Reduced operating expenses

- Strengthened partnerships across the industry

- Repositioned itself as a complete financial solutions platform to support the cannabis industry

In September, Safe Harbor also launched the first Fully Managed Cannabis Banking Program for financial institutions. This turnkey solution enables banks and credit unions to serve cannabis with minimal overhead and reduced risk, widening national access to compliant banking.

This innovation reinforces Safe Harbor’s reputation as the financial partner that not only built the first banking program but continues to innovate, expand and lead.

Safe Harbor Is Quietly Building the Backbone of the Industry

At Beard Bros Pharms and Beard Bros Media, we’ve spent years watching companies claim they are solving the industry’s problems while delivering very little. Safe Harbor is the opposite. They started by fixing the most dangerous issue in cannabis. Then they built tools for capital, operations, reporting, planning and long-term strategy.

This new platform is the industry’s first serious attempt at end-to-end financial support. It is not a theory. It is not hype. It is infrastructure.

And infrastructure is what cannabis has been missing.

Operators who want to stabilize operations, streamline finances, attract investment or prepare for consolidation should pay close attention. Safe Harbor is not just a banking provider anymore. They are shaping what the next decade of cannabis business management will look like.

A More Stable Future for Cannabis Starts With Better Financial Systems

The cannabis industry has endured policy uncertainty, aggressive taxation, inconsistent regulation and restricted access to capital. Even the best operators have been forced to build financial systems on shaky ground.

Safe Harbor is offering something the sector has never had: a complete financial platform designed exclusively for cannabis. Bank, Borrow, Operate and Grow represent more than services. They represent a roadmap toward long-term stability.

From secure banking to strategic finance, Safe Harbor Financial is giving operators clarity, control and a blueprint for the next era of legalization.

For the first time, cannabis has a financial solutions partner that understands the industry’s past and is building the systems required for its future.

Learn more by visiting Safe Harbor Financial.

- High Five: Jeffrey Kay, Safe Harbor

- The Veterans Safe Harbor Act: DC’s Claims Compared To Boots On The Ground

- SAFE HARBOR ACT 2019: New Legislation Looks to Provide Much Needed Reform for Vets

- SAFE Banking Added to Defense Bill, Hopes to Finally Survive Senate

- Advocates Put On Full-Court Press On Congress In Favor Of SAFE Banking Bill