I haven’t written anything in a while, and there are a couple of reasons for that.

First, I’ve had quite a bit of client work recently, keeping me busy. Work is always a good thing, right? Well, this leads me to the second reason why I haven’t written, and that’s because things have been heavy recently.

I’ve had a lot of new clients who are struggling. They can barely stay open and can’t pay their taxes and pay their employees, vendors, and all their other bills. These are all California operators who are doing their best, but everything is currently stacked against them. The illegal and hemp markets are thriving, and taxes are getting higher.

Which brings to me to why I’m compelled to write.

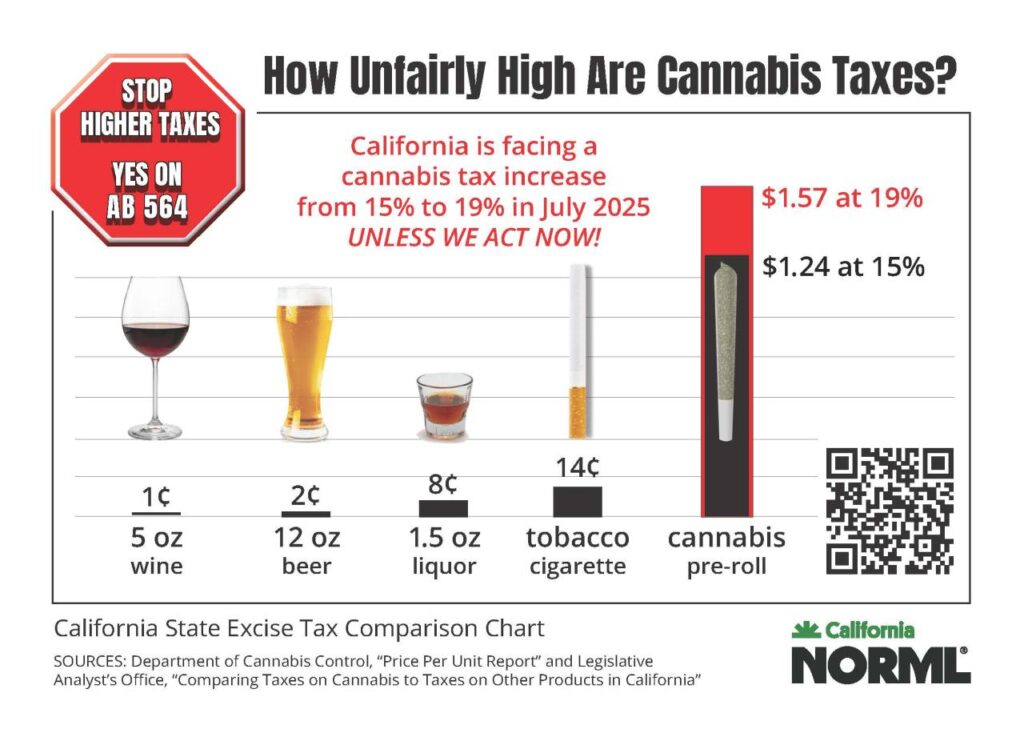

AB564 is the bill that would prevent the excise tax increase from 15% to 19% on July 1st. AB564 has made good progress, but we are not all the way there yet and need everyone’s help to ensure we get it across the finish line. Newsom just released his budget, and it includes the tax at 19%, so there is increased concern that we still have work to do.

Anyone invested in the legal cannabis industry continuing to exist in California should speak up about this. I believe that if the excise tax increase goes through, the CA market will start to crumble, as margins will be unsustainable.

Taxes on cannabis are already much higher compared to other categories, such as alcohol and tobacco. In addition, cannabis is a medicine that doctors recommend for patients, and medical patients are exempt from sales tax, but not the excise tax. Thus, this increase would also be on state medical transactions, which blows my mind.

But does it matter? Even without the increase, some cities in the state already have cumulative taxes of 40% on cannabis. How can that compete if we still have the illegal market thriving and more hemp brands all the time? We need more than AB564, but without it, more doesn’t matter; the industry won’t make it.

I’m going to write more about this and my feelings about the current market, but for now, if you haven’t already, please write to your representative and make sure they know the importance of AB564.

You can use one of the letters provided by California NORML and California Cannabis Operators Association–

CA NORML General Letter: https://lnkd.in/g4-J2-_y

CaCOA Consumer Letter: https://lnkd.in/gRt5f2zW

CaCOA Industry Letter: https://lnkd.in/gNAdy2h2

More from Dina at Beard Bros Pharms: