First and foremost, I hate that I am writing this (and hate that I started writing and then stopped and started again because of rumors of a last-minute ‘Newsom Hail Mary’).

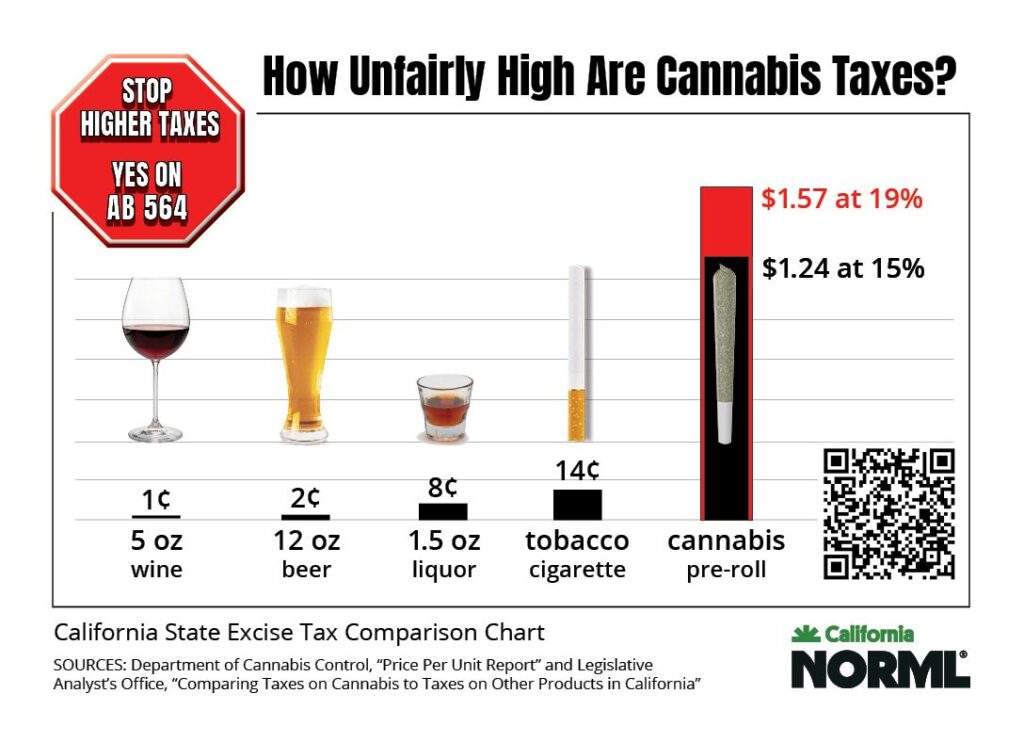

I was hopeful that with all the momentum we gained, we would be able to block the excise tax increase from 15% to 19% before July 1st, but unfortunately, we were unsuccessful. AB564 is still in play, and I am optimistic that we will get it passed the senate and the rate can return to 15%, but as of July 1st, the excise tax rate in CA will be 19%.

And while I write on a variety of topics, what I’m writing today is very specific to the work I do at Grass Goddess Consulting LLC, helping retailers with software and data. As someone who goes into dispensary Point of Sale (POS) software and configures tax settings and updates product data, what needs to happen this week is very near and dear to me. So I want to break down what this change means logistically and what retailers need to do to ensure they are updated.

The first thing to explain is that cannabis POS software has two ways that operators can set up their pricing. There is out-the-door or post-tax pricing and there is pre-tax pricing. It’s typically a setting in the software that can be toggled on and off.

If you are using out-the-door pricing, you set your product prices based on the amount you want the customer charged, including tax, and then based on your tax settings, the tax is back-calculated from that amount.

Pre-tax pricing is more traditional retail pricing, where the product pricing is set and then the tax gets added on top of that price based on your tax settings.

Depending on how the software is configured, it will have implications on your product prices and how these updates will need to be implemented. The main thing that needs to be considered is, do you want your customer to feel this price increase, or are you taking a further hit to your margins? It’s a complicated decision, and in cannabis, since competition is not just other retailers but also the illicit market and the hemp market, most retailers will end up eating this and will struggle even more than they already are.

To break down the specifics of what to do in the software, here’s what you need to know. If you have out-the-door prices and you want to keep your prices the same for the customer, you update the tax rate to 19% and you should be set. If you want to increase your prices by 4% so your customers assume the increase, you will need to update all your prices.

If you have pre-tax prices and you want to keep your prices the same, you will need to decrease your prices by 4% so with the tax rate at 19%, the total stays the same. If the increase goes to the consumer, you update the tax rate and are good to go.

Most of these things are straightforward but manually updating data is risky, and mistakes can be made. If you want assistance, I’m happy to help.

AB564 is still critical. Reach out to your senator!

More from Dina at Beard Bros Pharms:

Call to Action: Last Push For AB564 to Stop The Excise Tax Hike

NECANN Illinois Recap With Dina Nagib

Dina has spent most of her career in pharmaceuticals and biotech. Most of that was an 11-year career at Vertex Pharmaceuticals where she led Compound Management teams. This role required achieving excellence in managing an inventory of compounds, implementing quality-controlled processes, and developing software in a highly regulated environment.

After 15 years in the biotech space, Dina decided to take her knowledge and expertise and apply it to the rapidly expanding cannabis industry to ensure dispensaries maintain the high level of quality required to facilitate their success in the industry. Over the past few years, she has helped numerous dispensaries transition to new software and increase the efficiency of their operations. In addition, Dina wrote a successful dispensary license application in Illinois. More recently, she has worked with dispensaries on various data projects including applying cannabis tax amounts in California based on the amount of cannabis a product contains.

Dina is incredibly passionate about cannabis and social equity believing it is critical to the cannabis industry and therefore it is something she prioritizes in business.