“They’re everywhere. They’re looking at all locations,” says real estate broker Donny Moskovic about the “frenzy” as New York state plans to lease up to 150 retail properties to help marijuana businesses secure social equity leases for stores.

The intervention—part of a push to bring diversity to the legal cannabis market—may help marijuana dispensaries overcome the challenge of obtaining a license, which can be challenging without real estate, and of finding an appropriate space for a small business trading in a commodity that is still illegal on the federal level.

The $200 million fund—backed by state and private dollars—is aimed at giving entrepreneurs of color and other under-represented groups a head start in the state’s new recreational marijuana market. The move has been touted as the first of its kind in the US cannabis industry, with industry watchers saying it could serve as a blueprint for other states looking to roll out social equity programs.

While New York’s proactive approach to providing real estate and other support for social equity applicants has garnered praise for its progressive posture, it has raised concerns and criticism among industry stakeholders and real estate firms that the move could increase competition, drive up prices, with some even saying its not enough.

Find That Joint!

It’s been reported that at least one brokerage firm, CBRE Group, is already scouting locations on behalf of the Dormitory Authority of the State of New York (DASNY), the agency overseeing the fund disbursement.

And while the authorities have yet to announce how many adult-use licenses they will issue, regulators have indicated that half of the licenses will be reserved for social equity applicants. It’s also yet unclear when the licensing window will open, but CBRE spokesperson Jeffrey Gordon said their representatives are “looking for good retail locations throughout the state located in municipalities that have opted in to allow retail dispensaries.”

Moskovic said CBRE is most likely already looking in areas that didn’t already opt out of legal cannabis sales. That includes New York City as well as upstate. He has been working with Chicago-based Cresco Labs, looking to expand the company’s retail footprint in anticipation of the launch.

Big Apple, Big Steps, Big Market

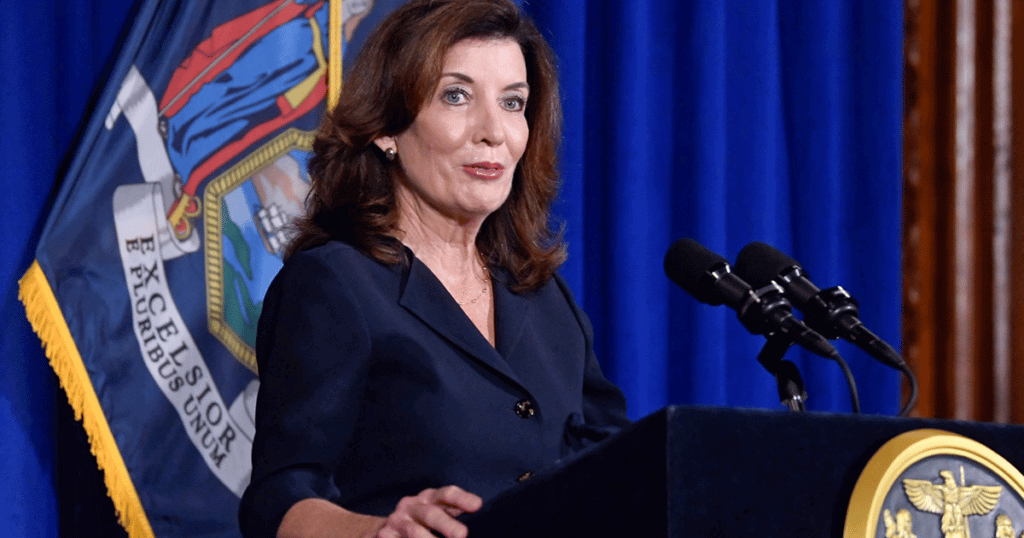

Democratic governor Kathy Hochul’s administration said in January they are committed to creating “the most diverse and inclusive” marijuana industry in the nation. “New York will lead where many other states have fallen short.” Indeed, the $200 million real estate initiative is among the largest interventions any state has committed to try to ensure diversity and social equity in the lucrative legal cannabis business.

The law that made cannabis legal in New York makes provision for supporting communities of color, and Chris Alexander, executive director of the Office of Cannabis Management, says he expects the first 100-200 licenses to go to people who were convicted of a cannabis-related offense before the drug was legalized; or those who have “a parent, guardian, child, spouse, or dependent” with a marijuana-related conviction.

“New York State is making history, launching a first-of-its-kind approach to the cannabis industry that takes a major step forward in righting the wrongs of the past,” Gov. Hochul says. And that “wrongs” according to a piece in the Cannabis Industry Journal, “are numerous and include mass incarceration and complex generational trauma, prevention of access to housing and employment and the forming of an illicit market – all of which have had a disproportionate impact on African-American and Latinx communities.”

Gov. Hochul says the regulations will help create jobs and opportunities for communities left out and left behind. “I’m proud New York will be a national model for the safe, equitable, and inclusive industry we are now building.”

Criticisms And Concerns

New York’s equity program, according to the Cannabis Industry Journal, has defined social equity applicants as being:

– Individuals from communities disproportionately impacted by the enforcement of

cannabis prohibition

– Minority-owned businesses

– Women-owned entities

– Distressed farmers

– Service-disabled veterans.

But as Amber Littlejohn, the executive director of the Minority Cannabis Business Association, told AP, while $200 million sounds great, “it’s really not so much the amount as it is the timing of the funding and services. And if that comes after the point of application [when applicants have already borne the initial costs] its ability to be impactful is really limited.”

Littlejohn further pointed to Illinois which also tried to roll out a social equity fund for its incoming adult-use market financed by pre-existing medical marijuana businesses, only for those same businesses to flop spectacularly and delay the rollout of the social equity program even further.

Opening a marijuana business can be extremely costly. With cannabis federally illegal, many banks and institutions are often reluctant to lend to sellers, growers, and processors. In addition, they’re ineligible for federal Small Business Administration-backed loans. As is the case with Charlotte Hanna who told AP that it took an army of consultants, lawyers, engineers, and tens of thousands of dollars in downpayment on a building to open her Massachusetts dispensary, Rebelle. She welcomed New York’s initiative as an “incredible” resource.

That it may be, but according to Colby Piper, a New Jersey-based real estate broker who specializes in marijuana, it’s “making it more competitive” for the industry as a whole. Piper, who like the CBRE reps, has been pounding the pavement scouting locations for clients wanting to start adult-use companies in New York, further points out that landlords often favor long-term leases with the state over deals with private businesses because the state is deemed a more reliable tenant. “When we find out, very quietly, where the state is looking, we can tell (our client), ‘This section might be too crowded; we should try the next block up.’”

With the sale of recreational marijuana expected to begin later this year, there’s bound to be fierce competition for retail space in Manhattan and Brooklyn. But there are clearly concerns about competition, price, and anxieties about how close dispensaries may be allowed to schools and churches.

When it comes to implementing the plan, questions remain, including how successful DASNY will be in trying to secure 150 retail locations in New York for 10 years with only a $200 million budget.

The money, NY state says, will come from “licensing fees and revenue from the adult-use cannabis industry and up to $150 million from the private sector,” not from the state general fund. “Depending on how they negotiate these deals, and when the actual rent triggers, it could be possible” to get 150 locations rented, says Piper, mjbizdaily reports.

Enjoyed that first hit? Come chill with us every week at the Friday Sesh for a freshly packed bowl of the week’s best cannabis news!