Although a growing number of state lawmakers and voters strongly support reform in the cannabis industry and cannabis banking laws, the federal government’s continued prohibition of the herb has created more than just conflicts between state and federal laws. The state of Pennsylvania is one of several that have recognized the need for safe banks for businesses in the cannabis industry. The governor of Pennsylvania recently signed a bill that includes safeguards for the state’s banks and insurers who do business with authorized medicinal marijuana businesses.

Bill to Safeguard Banks and Insurers

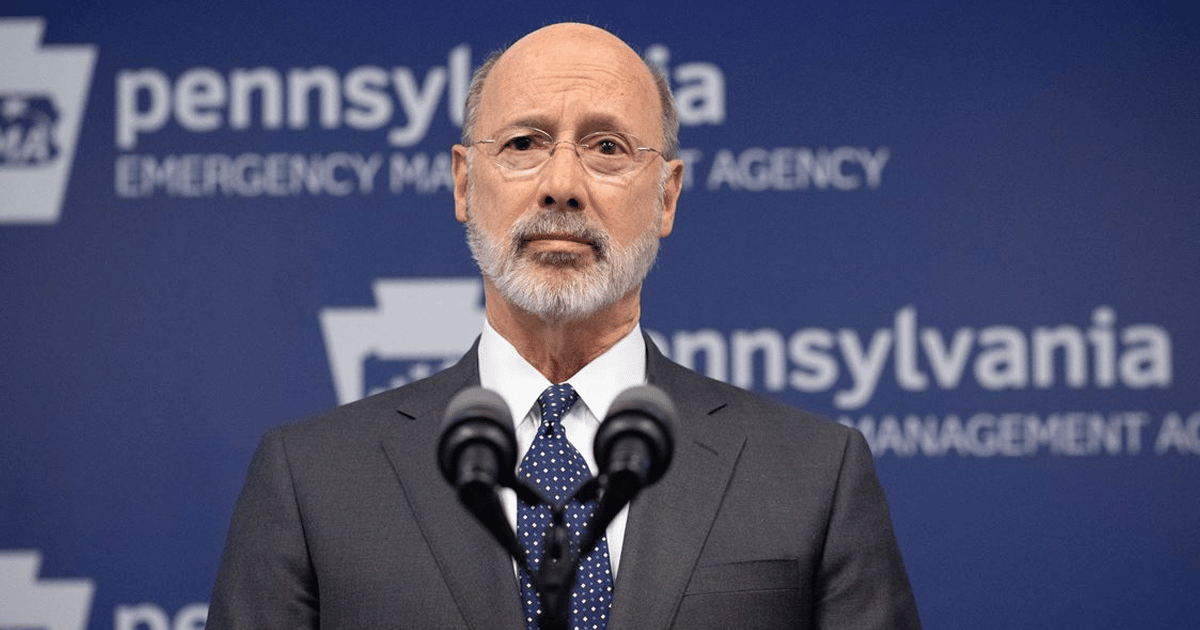

Governor Tom Wolf approved a bill delivered to his desk by the Republican-controlled legislature. It has protections to safeguard banks and insurers in the state that do business with authorized medical marijuana businesses. It is similar to a solo law that was advanced before being tacked onto another bill.

Governor Tom Wolf approved a bill delivered to his desk by the Republican-controlled legislature. It has protections to safeguard banks and insurers in the state that do business with authorized medical marijuana businesses. It is similar to a solo law that was advanced before being tacked onto another bill.

The cannabis banking reform was approved by the Senate earlier this year and by a House committee last month as a stand-alone proposal. Sen. John DiSanto (R), the principal sponsor, later added it as an amendment to HB 311, which has since been signed and allows some financial institutions to run savings marketing campaigns.

As Congress continues to put off passing a federal solution, states are attempting to protect financial institutions that are eager to serve the cannabis business. Another example of this is the Pennsylvania cannabis law.

The amendment contained in the approved legislation won’t shield banks and insurers from potential federal consequences, but it’s a stopgap move aimed at reassuring the financial industry that, at the very least, they won’t be subject to state law penalties.

Specifics of the Measure

A financial institution that is authorized to conduct business in this Commonwealth may provide financial services to or for the benefit of a valid cannabis-related business and the business associates of a legitimate cannabis-related business according to the law. The same safeguards will be legislated for insurers as well.

Financial institutions and insurers cannot be “prohibited, penalized or otherwise discouraged from providing financial or insurance services to a valid cannabis-related business or the business associates of a legitimate cannabis-related firm,” according to the law.

It also states that banks or insurers will not be obligated to offer services to medical marijuana firms – you know, free will and all that jazz. However, the bill does state that organizations cannot “recommend, reward or urge a financial institution or insurer” to refuse services merely because a company is connected to cannabis. So while financial institutions don’t have to offer their services to cannabis businesses, they may also not discourage others from doing so.

Additionally, state agencies would be prohibited from “taking adverse or corrective supervisory action on a loan given to a legal cannabis-related enterprise.”

Pressure on Government = Progress on Cannabis

In April, Pennsylvania unveiled another cannabis banking plan which was intended to help shield banks and insurance providers from state fines for cooperating with state-approved medical cannabis enterprises.

The bill introduced in April (this more recent cannabis banking reform bill) and numerous others that state legislators are attempting to bring to the table may put additional pressure on congressional lawmakers to enact a federal change, which is something that everyone in the cannabis industry wants.

There would be no need for this latest bill if it weren’t for banks and insurers abandoning customer accounts, refusing to hand out loans, and pulling lines of credit because they do not want to be associated with the industry. However, we have the feds to thank – or condemn – for that just as much as the banks. The increasing support from states for legalized cannabis is a positive sign that while the government continues to fail the cannabis industry at a federal level, state representatives will continue to step up to the plate.

Enjoyed that first hit? Come chill with us every week at the Friday Sesh for a freshly packed bowl of the week’s best cannabis news!