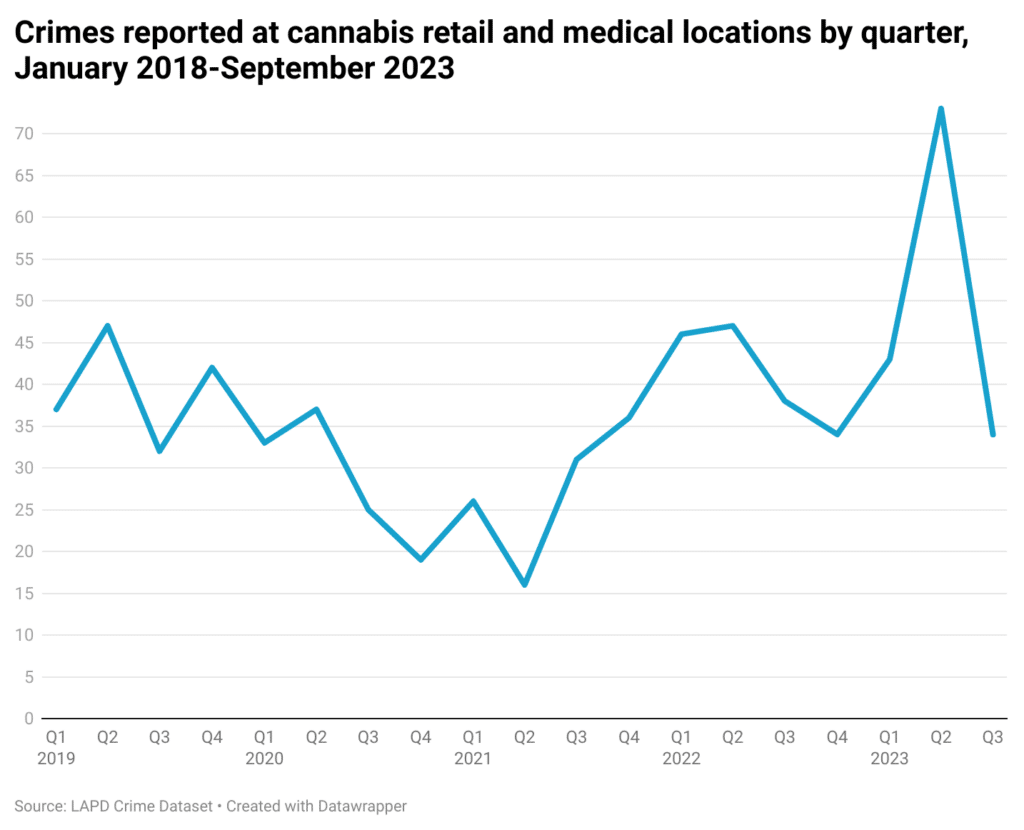

Cannabis dispensaries across Michigan and California are dealing with an uptick in break-ins, a troubling trend that’s shaking the industry. In Michigan, Detroit’s dispensaries have reported 20 incidents this year, and California’s numbers are even more staggering, more than doubling the previous year’s figures.

These break-ins have grown more brazen, with Brian Hana from the Michigan Cannabis Regulatory Committee noting, “It’s a symptom of what’s happening nationally, and something needs to be done.” Thieves are resorting to drastic measures such as ramming into storefronts to loot valuable products.

Amidst this, law enforcement’s response has often been lacking, with B.J. Hughes of SOG Army highlighting slow reaction times and a lack of proactive follow-up.

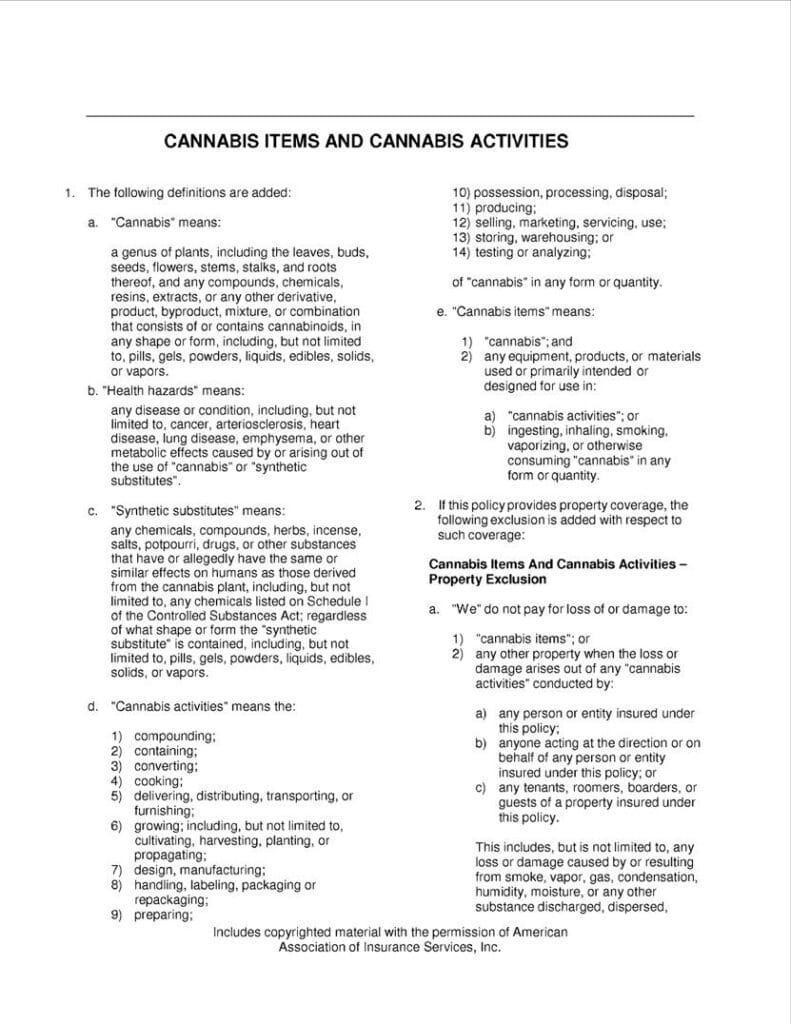

For businesses, this spike in crime is worsened by the insurance sector. Many find themselves underinsured due to policies riddled with exclusions. A typical landlord’s policy for properties leased to cannabis operations might include comprehensive definitions of ‘cannabis’ and related activities but will distinctly exclude coverage for losses directly tied to these products and activities. This creates a significant coverage gap that could leave property owners financially exposed following cannabis-related incidents at their properties.

As an insurance professional, I see the pitfalls of such policy exclusions daily. Dispensary owners must be diligent in understanding every aspect of their coverage. With the risk profile escalating, ensuring a safety net that adequately protects against current threats is more important than ever.

Business owners should re-evaluate their insurance coverages in the face of this surge in theft. Strong security measures and solid partnerships with local law enforcement are critical for maintaining safety. In these challenging times, proactive risk management is not just prudent—it’s essential for the industry’s longevity.

About The Author

Alexander F Medina

Founder of The Puro Company

Founder of Builders & Contractors Insurance

Alexander Medina, an accomplished entrepreneur and writer, brings a wealth of expertise to his work. With over 15 years of experience in the cannabis industry, Alexander has established himself as a pioneering figure, notably as the founder of Puro Co. His entrepreneurial journey extends into the realm of commercial insurance, where he has over a decade of experience and is recognized as the founder of Builders & Contractors Insurance Services. His unique blend of insights from these diverse sectors enriches his writing, offering readers a nuanced and informed perspective on a range of topics related to entrepreneurship, business strategy, and industry-specific challenges and opportunities.

Keep updated on all the latest news and updates in the Cannabis industry here at Beard Bros Pharms by signing up for our Friday Sesh Newsletter here. Always Dank and Never Spam!