Cali Cannabis Regulators Respond to Industry & Consumer Demands for Tax Relief by… Raising Taxes

Cali Cannabis Regulators Respond to Industry & Consumer Demands for Tax Relief by… Raising Taxes

You’ve heard of Occam’s razor, right? It’s basically a problem-solving philosophy that states that the simplest answer is usually the correct one. This has been borne out in scenarios from the mundane to world-shaping decisions all day every day ever since Mr. Ockham blurted it out back in the 14th century.

When the final regulations that would form the framework of Prop 64 truly began to come into focus, we immediately realized exactly how deeply the deck was stacked against us and other legacy operators like us, and our best theory was the simplest one: it is far easier for the state to oversee 500 licensees – particularly a bunch of corporate carpetbaggers – than try to ensure that tens of thousands of worthy and deserving candidates be given a seat at the table.

Today’s announcement from the California Department of Tax & Fee Administration (CDTFA) to all licensed operators in Cali unfortunately only cements the worst of our fears, that indeed the state has no interest in a level playing field and, in fact, is trying to keep all the real players on the sidelines.

TAXATION WITHOUT REPRESENTATION

It is no secret that the taxes imposed on regulated cannabis and cannabis products here in California are astronomical, with retail customers paying 30-40% in some cases, on top of already high base prices. This sticker shock at the register is what keeps so many cannabis consumers from ever going back to a legal dispensary and instead going back to the streets where “exit bags” are made by Ziplock and the only time you feel taxed is when the weed man is 20 minutes late or the 8th weighs 3.49 grams.

What most retail customers don’t realize, however, is that the people who actually produce their favorite strains and products are also being taxed at several stops along the supply chain. Be sure to read THIS ARTICLE to see how much 1 gram of legal weed gets marked up from seed to sale.

There have been impassioned pleas up and down the state from cannabis advocates who lay out compelling reasons for why either their local municipality or the state itself should consider lowering the tax burden on the industry. The state is suffering from embarrassingly low cannabis-related tax revenues since, as described above, savvy consumers are refusing to pay the legal markup when the streets are still flooded with lower-priced (and often higher quality) options.

So today, the CDTFA announced its answer to those pleas.

They are RAISING taxes on both growers and dispensaries which will directly translate to even higher prices for customers. Licensed growers are pretty much starving in this system already and will not be able to absorb the additional cultivation taxes soon to be levied. Dispensaries operate on larger margins than growers, in most cases, but also have incredibly high overhead and we don’t see them “eating” or absorbing the increased tax pinch from the state either. But, when the taxman cometh, somebody has to pay and that somebody will be the alleged 20% of cannabis consumers in California who actually visit legal shops to refill their stash.

Honestly, we think that number is generously high, but with higher taxes/prices imminent, how does the state expect to grow that number?

THE BREAKDOWN

Ok, so here is what came down from the suits in Sacramento just today.

CULTIVATION TAXES

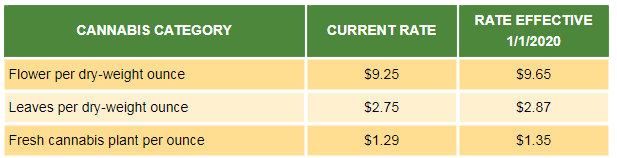

Currently, every legal, licensed cannabis grower is made to pay a cultivation tax on every harvest. This tax is applied to both flowers/buds and trim/shake, though the two have different taxable rates.

For now, the tax on dry cannabis flowers is $9.25 per ounce. With 16 ounces in a pound you can see that growers are paying the state $148/lb. Trim, or “Leaves” as they call it, demands a vig of $2.75 per ounce. Cultivation advocates rightfully argued that basing the tax on weight alone is ludicrous – indoor fire can go on to sell for $2000+/lb while outdoor mids might only fetch $500-600. One farmer is paying a much higher tax than the other when you look at it that way.

So what does the CDTFA do?

As of January 1st, 2020, dry flowers will be taxed at $9.65/oz and “Leaves” at $2.87/oz. Fresh plants will also be taxed higher because the state says it needs to keep up with inflation. Apparently, “inflation” doesn’t affect the supply side of a crippled industry…

This will not encourage more legacy farmers to make the leap into legal weed. It will further drive home the ultimatum that you can either become a slave to the state or you can quit growing. Oh, and if you don’t quit growing, you might get a Blackhawk helicopter landing on your roof.

The cultivation tax should be ZERO for the next five years. The same five years that were stolen from small to mid-size growers once “license-stacking” was permitted and market share got dominated by well-funded boof-herders.

That will be the direct result of this move – prices will go up, quality will go down. The people who see cannabis as a vehicle to profits don’t mind that result one bit but they fail to see the forest for the trees. The industry has not even scratched the surface of the potential market of cannabis consumers in Cali. If massive revenues are the only goal, even just a blip of upward movement on the scale of consumers who patronize the legal market would more than offset and even eclipse whatever revenue is trickling in from cultivation taxes. That movement will never occur as long as prices remain as high as they are and as long as overall quality remains where it currently is.

In cultivation lingo, there is a term called “systemic” for when an entire plant is suffering from a specific problem. California’s cultivation tax is a systemic problem for the industry, and the CDTFA just made it worse.

MARK-UP RATE

Ok, time to get a little wonky but bear with us.

The CDTFA has been tasked by some other nerds to readjust what it calls the industry “mark-up” rate every six months. The mark-up rate is essentially the numerical difference between how much a product sells for on the wholesale level, and how much it then sells for on the retail level.

In the headshop culture, for example, it is common for retail stores to demand low enough wholesale pricing from distributors and manufacturers that they can then double that price, creating what is commonly known as a “keystone” markup. This bong sells to the shop for $100, the shop slangs it to the custy for $200, the shop doubles its money.

Many cannabis dispensaries tried to adopt that same keystone model, doubling the wholesale price and then tacking on the outrageous taxes for every retail sale. Understand that most grocery stores operate on about a 1-3% margin. Of course, grocery stores are not as heavily scrutinized by the IRS and the feds as a cannabis dispensary is, but demanding a margin that allows for a 100% markup is not what the state envisioned when it formulated its tax plan for the industry.

Currently, the CDTFA assesses taxes on dispensaries based on a 60% markup rate. The thing is, we all know the shops are charging a higher mark-up than that – they have been since the Prop215 era. It seems that the state figured that out too. As of January 1st, 2020, the new mark-up rate imposed by the CDTFA will be 80% as the state has clearly decided that they are not getting what they feel is their entire piece of the pie.

Where the fuck is our slice?

As mentioned before, legal cannabis dispensaries take on massive amounts of liability, huge investments in products with a relatively short shelf life, and cannot employ the same crucial tax benefits and write-offs that every other retail store in America can. Some run on tighter margins than others, to be sure, but we don’t see any of them – regardless of their level of success or profitability – absorbing this increased blow from the tax collectors. Again, though, someone will be made to pay and that tax hike will likely be felt at the register.

The state has done little or nothing to instill confidence in either the folks who have taken the enormous risk to enter the regulated market or the folks on the outside looking in. In a recent interview, California Bureau of Cannabis Control Chief Lori Ajax admitted that there are no “short-term fixes” for the hamstrung industry. How do you fix something that becomes more broken by the day?

Keep updated on all the latest news and updates in the Cannabis industry here at Beard Bros Pharms by signing for our Friday Sesh Newsletter here. Always Dank and Never Spam!