One week ago today, California Governor Gavin Newsom proposed a temporary suspension of the state’s cannabis cultivation tax currently assessed on every ounce of flower, trim, leaf, and larf produced by licensed growers.

One week ago today, California Governor Gavin Newsom proposed a temporary suspension of the state’s cannabis cultivation tax currently assessed on every ounce of flower, trim, leaf, and larf produced by licensed growers.

Of course, the cultivation tax is just one layer in the burdensome stack of taxation that has crippled the Cali cannabis market from seed to sale, so let’s take a look at what exactly the Gov is proposing, what impact if any it will have on the struggling regulated market, and if it is even grounded in reality or if its just more BS from a politician up for reelection.

PROPOSED CALI CANNABIS TAX REFORM: PAY NO ATTENTION TO THE MAN BEHIND THE CURTAIN

First, let’s look at what Gov. Newsom actually proposed.

The state’s current cultivation tax rate charges medical and recreational growers $10.08 per ounce of flower, $3.00 per ounce of trim, and $1.41 per ounce of fresh cannabis plant. That’s pretty easy math, you’re looking at $161.28 for every pound of buds harvested.

The wholesale price of many forms of cannabis has plummeted in the past year to the point where some outdoor growers are having a hard time getting $300/lb.

Out of that $300, the cultivation tax must come right off the top, paid by the farmer to the state, leaving less than half of the wholesale price as potential profit.

Of course, there is no profit once you factor in labor costs, compliance/licensing costs, a certain percentage of crop loss, etc. In fact, many farms are on the verge of financial collapse if they haven’t failed already.

Many of these farms are multigenerational, having been handed down through a family dedicated to being conscious stewards of that land, only to lose it all to “legal” weed.

When Gov. Newsom announced his proposed tax relief last week, he specifically said that the aim of the effort would be to strike a blow against the highly successful illicit street market for cannabis in Cali, but the plight of these small farmers must certainly weigh on his decision as well.

But will a temporary suspension of the cultivation tax be enough to keep legacy cultivators afloat?

A recent study released by the Reason Foundation demonstrated that a permanent elimination of California’s cannabis cultivation tax would actually INCREASE the amount of tax revenue flowing FROM the cannabis market BACK TO the state by 123% by the year 2024. Of course it would! You can take a nickel out of 100 dimebags or a penny out of 1000, which would you pick?

From the farmer’s perspective, of course, it can only help to keep that $161.28/lb on the farm, but that is a drop in the bucket compared to the other costs associated with operating in the (over)regulated market.

[RELATED READING: Taxed to Death – Follow One Gram of Weed on California’s Twisted Path From Seed to Sale]

It is also disproportionately advantageous to the large-scale boof-herders who are growing literal tons of mids that nobody wants, nobody buys, and that are depressing the market both financially and spiritually.

This inevitability potentially hurts smaller-scale craft cannabis farmers more than the suspension of the tax helps them.

So, even at face value, the efficacy of Newsom’s proposal is iffy at best, but as with most politicians, if you just barely scratch at the surface of it all, it only gets worse.

STEP RIGHT UP! PLAY THE SHELL GAME!

From street scammers to so-called magicians, the only real ‘trick’ is to distract the mark enough to pull off the illusion and/or take their money.

The classic shell game is the perfect example of it, with that distraction being on full display as the shells are quickly shuffled around before your very eyes. You can focus as hard as possible on the correct shell and confidently point to it once they come to a halt only to be disappointed when your choice reveals nothing but another loss for you.

That’s probably an apt analogy for what Newsom is floating to the media.

You see, while we are talking about a suspension of the cultivation tax, and while we can provide proof that lowering taxes leads to MORE tax revenue, Newsom’s proposal quietly slips in a provision to RAISE the state’s cannabis excise tax from 15% where it currently stands, up to 19% in 2025.

You followed the right shell, you were told there was tax reform underneath… BOOM! A TICKING TIME BOMB OF INCREASED EXCISE TAX… PAY UP SUCKER!

In his mind, Governor Newsom may think, “Well, the farmers don’t pay the excise tax…”, but we all know who will be asked to pay it – the consumer – and most of those consumers are already answering by laughing at the local dispensary as they drive to the plug’s house for actual good, affordable weed.

Right now, if you stumble into a licensed dispensary and ask for a $50 8th of weed, you’ll wind up paying $60-75 for it after local sales tax, state sales tax, and state excise tax are added to your receipt. Notice that you don’t see cultivation tax on your receipt, so suspending it will not affect the consumer’s bottom line. Beaten down farmers temporarily saving $161.28/lb will not affect the consumer’s total either. You know what will, though? A bump up in the excise tax.

REAL SOLUTIONS

In the example given above of walking into a legal pot shop to buy an 8th of weed we didn’t even mention the fact that your experience will be limited to looking at logos and labels to guide your decision since you cannot see or smell any of the cannabis for sale. It will have been stuffed into undersized jars or flattened in mylar bags months before you showed up looking for good, fresh weed. If you can recognize a brand that you trust, or if you feel good about some random geometric potleaf logo on a particular brand, then you get the experience of laying out 30-50% in taxes to buy it.

There is no connection between the farmer and the consumer and the current quality of the product on dispensary shelves across California reflects this.

I care about my plug. He’s a person. I can connect.

If the Gov wants to discourage people from patronizing the unregulated cannabis market you have to give them a reason!

“Legal” weed should be better and cheaper than it is on the streets due to third-party lab testing and being able to grow and process your crops without constantly ducking the law. That openness should allow farms to market, communicate, connect, and sell directly to consumers.

If Governor Newsom truly cares about these things, there is a bill making its way to his desk right now known as Assembly Bill 2691 that would allow small cannabis growers to sell directly to consumers at special events.

Fast track that, Gav.

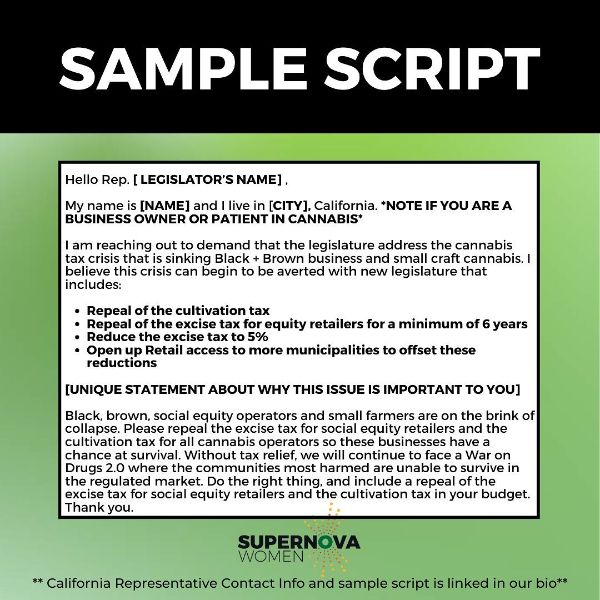

Permanently eliminate the cultivation tax and cut the excise tax to no more than 5% and cap local municipalities at the same rate. Substantially lower the barrier of entry into the market, and the compliance costs once in, so the street market all-stars might be incentivized to hop onboard. Open at least as many dispensaries as liquor stores and then prepare for the tsunami of cannabis tax revenue that floods your coffers.

Unless, of course, you are just acting out some performance politics leading up to your hopeful reelection in the fall…

However, the sad truth about prop 64 is that Gov Gav doesn’t have that power even if he had the will.

You may have noticed that we keep saying that he is “proposing” the suspension of the cultivation tax, and that’s all he can do is propose. Because the doomed-to-fail legalization law was written into the state constitution, to go into effect, Newsom’s proposal must be approved by a two-thirds majority of the state legislature by June 15, 2022.

If this proposed tax reform makes you feel any type of way, let your state representative and the gov’s office know! Those shells are moving fast these days.

- Maryland Leads the Way in Cannabis Pardons, Setting an Example for Much-Needed Cannabis Reform

- Military Construction and Veterans Affairs Bill Amendments Could Change Medical Marijuana and MDMA-Assisted Therapy Options for Veterans

- Thailand’s U-Turn on Recreational Cannabis Use

- Chicago Police Department Revises Policy on Searches Based Solely on Marijuana Odor

- Ohio’s Senate Bill 56 Postponed, Leaving Details of Issue 2 Still Unresolved

- Sports Stars and Well Known Entertainers Join Forces Calling on Trump for Cannabis Reform