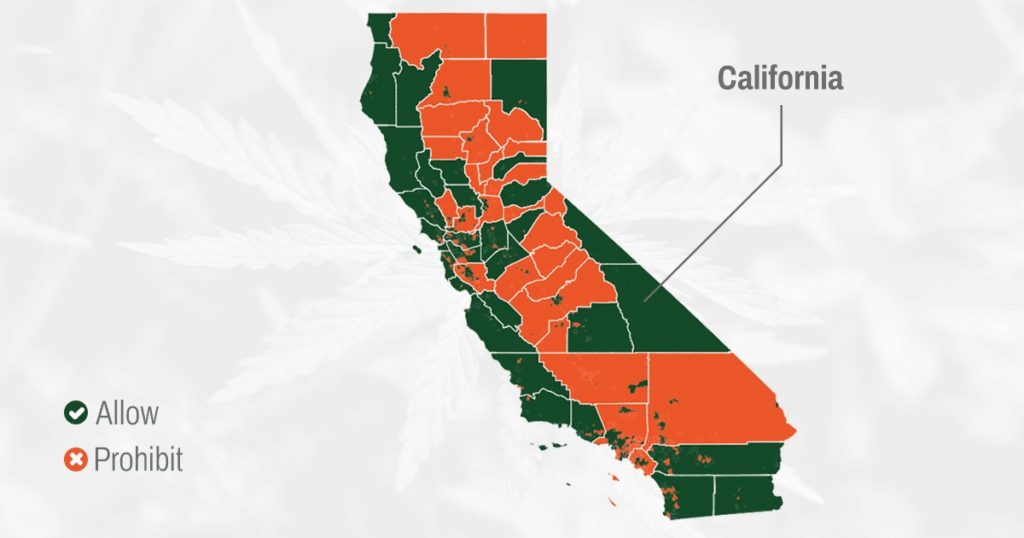

Launching new resources enables the DCC – Department of Cannabis Control – to emphasize the lack of access in California. The new tool highlights areas in the state where cannabis can be purchased from legal sellers and areas where it is restricted. The conclusion was that 56% of areas restrict licensing, a huge hurdle to gaining widespread access. How can this tool be used by the DCC to bring more awareness and change to the areas?

The Work That Lies Ahead

The interactive map helps to share some key points of information:

- Where legal and safe cannabis products can be purchased by licensed retailers.

- Which counties allow licensing

- Where testing may take place

- Areas where manufacturing is legal

- Counties that may distribute cannabis products

- Which areas support marijuana cultivation

By putting in the research to identify these areas, it allows the relevant stakeholders to drive change. The research revealed that 62% of counties do not permit retailers, which in turn can cause a spike in illegal cannabis sales. A positive outcome has been that Sen. Scott Wiener (D) is sponsoring legislation that will allow patients to receive medical marijuana anywhere in the state, regardless of what local policies prohibit. This is a forward step to improving access and promoting education. The DCC wants to use public feedback to develop more strategies for consumer education. In January officials announced a $100 million fund to help develop markets. The funds were distributed to 17 cities and counties to level out cannabis licensing opportunities.

Zeroing Out Cultivation Tax – A Hidden Agenda

California Governor Gavin Newsom proposed a temporary suspension of the state’s cannabis cultivation tax that is currently crippling the industry. When peeling back the multitude of layers that is levied on farmers, a huge problem is revealed. A simple table illustrates the massive taxes that cannabis farmers face.

| Tax per ounce of flower | Tax per ounce of trim | Tax per ounce of fresh cannabis plant | Total per pound of buds harvested | Estimated price of resale per pound |

| $10.08 | $3.00 | $1.41 | $161.28 | $300 |

| Estimated profit | +/- $138 |

The estimated profits are still cut smaller and smaller by production costs and leaves a small fraction, if anything, for the actual profit of the farmer.

The suggested lift in taxes is a very dubious side that will enlarge the market for mass production and cut the throats of the generational farmer, all while pouring more money into the state pockets. If the tax is lifted and the market increases, so do the wallets of the state as the market will explode. The state still collects several other cannabis taxes, including general sales taxes on cannabis sales.

If California should eliminate the cultivation tax, they still stand to earn 123% more in total monthly marijuana-related tax revenue by 2024 than it currently does. Would this truly work in the market and work to eradicate past discrepancies related to cannabis?

Major gaps in the legislation battle have been brought to light, but will serious steps be taken to address these? There is a major disconnect between farmers, product developers, and consumers. This disconnect allows the illegal trade to flourish whilst licensed farmers are falling behind in the dust. The end goal must be to eradicate the illegal trade by creating a licensed, monitored, and controlled cannabis trade that can bring a product to the market with lower cost and better quality than the illegal trade.

The DCC is taking major leaps in publishing new resources that help to highlight the problem areas and call attention to where it is needed. The next big step would be for legislation to actually start taking steps to support the industry in a way that will offer longevity, quality, and control.

Enjoyed that first hit? Come chill with us every week at the Friday Sesh for a freshly packed bowl of the week’s best cannabis news!