California’s cannabis industry is facing an unprecedented crisis, with cannabis companies going out of business due to missed tax payments and millions in debt. The state’s decision to shift tax payments from distributors to retailers has put many retailers at risk of failing, as they are unable to come up with the funds they owe. This has led Assemblymember Phil Ting to propose a law that would track and punish companies that don’t pay their suppliers.

The long-term consequences of this situation could be dire for California’s cannabis industry, as it could lead to an “extinction event” where dozens of businesses shut down and thousands of jobs are lost. But some believe there is a silver lining in this crisis: better operators may enter the market and drive the industry forward.

California Debt

California’s cannabis industry has been burdened with debt for some time, with many businesses unable to pay their suppliers and racking up millions of dollars in debt. According to Brett Gelfand, the managing partner of CannaBiz Collects, a cannabis-focused debt collection agency, this problem has grown so severe that “we’re seeing the same debtors over and over again. Sometimes we have 20 different clients submitting their claims against the same debtor, so the debtor is drowning in debt.”

This situation has led to what Assemblymember Phil Ting calls an “extinction event” for California’s cannabis industry – with dozens of pot shops going out of business, thousands of jobs lost, and millions in tax revenue evaporating. To combat this crisis, Assemblymember Ting has proposed a law AB 766 that would track and punish cannabis companies that don’t pay their suppliers.

But the debt problem isn’t just limited to retailers – it stretches across the entire supply chain, from producers to distributors to retailers.

The situation has been further exacerbated by a recent change in how taxes are paid. Prior to this year, cannabis companies paid their taxes to distributors, who were then responsible for paying the state. Now, however, retailers are responsible for their own tax payments – and many of them simply don’t have the money they owe.

This shift has put retailers at risk of going out of business. “Most cannabis companies just don’t have the cash flow or resources necessary to make these payments on time, much less on a regular basis. The result is that we’re seeing an increasing number of cannabis businesses shuttering their doors as they miss tax payments and succumb to debt.”

Silver Lining?

Despite the dire situation, some are optimistic that this crisis could lead to new opportunities for the industry. Gelfand believes that “as debtors in the cannabis industry go out of business, it could open up new markets and allow better operators to enter the market and drive the California cannabis industry forward.”

Indeed, if Ting’s bill is passed, it could create a level playing field by forcing companies to pay their debts on time and providing a clear picture of who is doing what in the cannabis space. This transparency could make it easier for more responsible operators to enter the market – helping propel California’s pot industry into a brighter future.

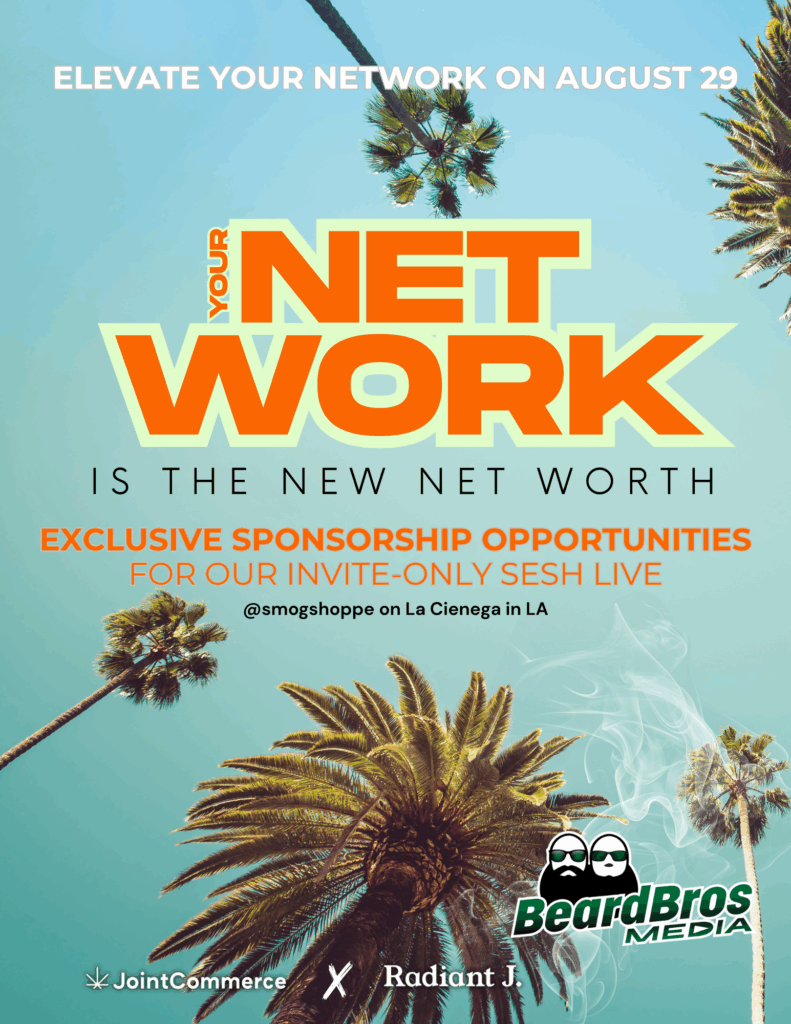

Enjoyed that first hit? Come chill with us every week at the Friday Sesh for a freshly packed bowl of the week’s best cannabis news!

- Trial Begins for Ex-Rohnert Park Officer Accused of Corruption, Highlighting Failures in Cannabis Law Enforcement

- From Los Angeles to Berlin: How U.S. Cannabis Growers Can Lead in Europe — with Germany as the Launchpad

- Federal Judge Upholds Gun Ban for Cannabis Users Despite State Legalization

- Czech Republic Takes Historic Step Toward Cannabis Reform

- Case Study: Financial Litigation Support for a Cannabis Business

- Oregon’s Ryan’s Law Bill Stalls Again, Advocates Vow to Continue the Fight

One Response

Stupid way to “fix “ and obvious problem. Non payer will just go back to trapping. Btw I never sign vendor contracts on GP. So how would you enforce that. And let’s have the government solve more problems what can could go wrong