December 4th, Two Thousand and Twenty, a date that will live in infamy… at least among the cannabis community… at least among those in the community that pay attention to politics.

December 4th was the day that the United States Congress put cannabis reform up for debate on Capitol Hill, a first in our nation’s history. Cannabis came out victorious that day as the U.S. House of Representatives easily passed H.R. 3884, commonly referred to as the MORE Act, by a full floor vote of 228 Yea to 164 Nay.

With that historic passage, the More Act heads to the United States Senate, where its fate remains unknown as control of that deliberative body also remains unknown.

Here’s what we do know. The MORE Act is an ambitious piece of legislation that has, so far, overachieved, fueled mostly by the wave of grassroots momentum behind the cannabis movement.

Together our advocacy has made cannabis a “safe” issue for progressive politicians to embrace.

Unfortunately, as happens far too often in the sausage-making of U.S. politics, the MORE Act of today is a gnarled Frankenstein version of how it began, as concessions get made – Left and Right – to garner support from both sides of the political aisle.

It’s safe to say that the MORE Act needs more work.

THE GOOD

The MORE Act is an acronym that stands for the ‘Marijuana Opportunity Reinvestment and Expungement’ Act.

Opportunity. Reinvestment. Expungement.

Like chicken pot pie, those are three of our favorite things.

But you don’t have to dig too deep into the current version of the MORE Act to find some rather unsavory ingredients getting baked in. First, though, let’s look at what it gets right.

The first two lines of H.R. 3884 are the words that cannabis activists have been waiting a lifetime to see:

This bill decriminalizes marijuana.

Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.

The implications of this are monumental, of course. Removing the cannabis plant from the scope of federal law enforcement would have such wide-ranging consequences, each one of which deserves an entire article to cover.

The implications of this are monumental, of course. Removing the cannabis plant from the scope of federal law enforcement would have such wide-ranging consequences, each one of which deserves an entire article to cover.

From the macro (interstate and international commerce, Wall St., research, veterans’ rights, criminal justice reform, etc.), to the micro (home grows, stigma, personal health), America will absolutely benefit from the removal of cannabis from the Controlled Substances Act.

That alone is almost worth rubber-stamping the rest of the MORE Act… almost. There is more to appreciate first, though.

The bill, as written, would also:

- replace statutory references to ‘marijuana’ and ‘marihuana’ with ‘cannabis’, which I guess would make it the CORE Act? Kind of telling about how out of touch even some of our political allies are that they used their own banned word in the title.

- require the Bureau of Labor Statistics to regularly publish demographic data on cannabis business owners and employees. Let’s get some real stats on diversity in cannabis, so we can fix it.

- establish a trust fund to support various programs and services for individuals and businesses in communities impacted by the war on drugs. Sort of sounds like social equity… go on…

- make Small Business Administration (SBA) loans and services available to entities that are cannabis-related legitimate businesses or service providers. It’s about time! This will open the marketplace to legacy operators, mom & pops, and neglected communities who will no longer have to bend the knee to aggressive investors or hard money loans if they want to get in the game.

- prohibit the denial of federal public benefits to a person on the basis of certain cannabis-related conduct or convictions. Again, about f*#kin time. That word “certain” is a bit problematic, though, and will need to be clearly defined.

- prohibit the denial of benefits and protections under immigration laws on the basis of a cannabis-related event (e.g., conduct or a conviction). Good. Cannabis is not to be used as a tool for law enforcement. Unless they want to start smoking it… have at it, boys!

- establish a process to expunge convictions and conduct sentencing review hearings related to federal cannabis offenses. This is huge. State and local level expungement efforts have already reduced or cleared the criminal records of hundreds of thousands of Americans, but they have not been able to touch federal crimes, yet. This needs to be among our highest priorities, not only in the cannabis community but in our society at large. We cannot have executives pulling six-figure salaries and communities being rebuilt all from a legal cannabis market while you still burden members of that community with past petty weed charges.

- direct the Government Accountability Office to study the societal impact of cannabis legalization. Cool. Study it. You will find the same benefits that we’ve known about for quite some time and, in the process, put the final nail in the coffin of Prohibitionist fearmongering.

THE BAD

If you saw point number three up there and thought, “Trust fund? Where’s the money come from?” Ding!Ding! Congratulations, you’ve been paying attention!

You see, not only is legal cannabis expected to pay for law enforcement, community development, rehabilitation services, education, and more, it also has to pay its own way, apparently.

You didn’t think that Uncle Sam was just going to let us have cannabis, did you?

He wants his cut. He always wants his cut.

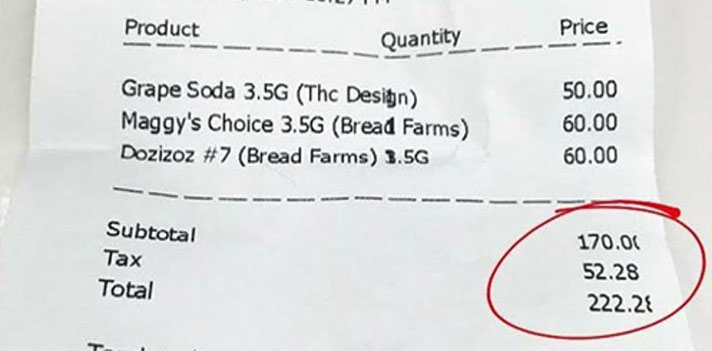

In this case, that cut is being proposed as a 5% federal tax on all regulated cannabis sales nationwide. This will equate to billions of dollars in brand new annual tax revenue for the Feds, and they say they will appropriate it to social equity efforts, but what effect does it have on the supply chain?

Here in California, the average cannabis consumer is quoted one price on a jar of weed in the regulated market, but after they check out, they realize that they paid 30-40% more than the price tag. That’s because the state and local municipalities have stacked multiple sales and excise taxes on top of the purchase price, jacking it up to absurd levels.

In Oregon, they do not pay sales tax on anything. Well, almost anything.

Buy a burger for $4.99 and they charge you $4.99.

Buy a new car for $49,999 and they charge you $49,999.

Buy a half-ounce of weed for $149 and suddenly a 20% sales tax appears.

Now add another 5% on top of these totals and it absolutely will price out a significant number of would-be cannabis consumers.

It also adds more muscle to an already-bulging traditional market that doesn’t bring tax math into the equation.

It gets worse. The MORE Act, as written, would call for that 5% federal cannabis tax to incrementally increase up to 8% over the course of the next five years.

Yes, taxes on cannabis are bad but we realize that Uncle Sam is going to pinch the sack somehow, so our best bet is to try to chop away at that 5% right away, and refuse to let it go up.

THE UGLY

So, they want to slap a 5% tax on every bag of buds in order to create a trust fund to finance their idea of social equity.

At face value, that is a flawed but admirable stance.

In reality, the MORE Act as currently written might be the biggest assault on social equity that we have seen come wrapped in the flag of cannabis reform.

If you carefully parse the language that was included in the earlier versions of the MORE Act versus the language that it contains now, there is a giant red flag when it comes to licensing.

We first caught wind of this addition, and its potential implications, in an excellent blog article written by our friend and esteemed cannabis attorney Omar Figueroa which you can read in full HERE.

Here’s the breakdown, though.

Section 5 of the MORE Act covers broad regulations regarding applying for a federal cannabis permit. Yep, there will be a fee for that, too. But again, it gets worse.

The language in Section 5 dictates that an application may be rejected, and a permit denied if the Secretary of Treasury finds that the applicant is “by reason of previous or current legal proceedings involving a felony violation of any other provision of Federal or State criminal law relating to cannabis or cannabis products, not likely to maintain operations in compliance with this chapter.”

Wait a second… Weren’t we talking about expungement a minute ago? Isn’t it in the damn name of the bill? Or will that get changed too?

Arbitrarily excluding people who got nailed with unjust weed-related felonies – literally the victims of the failed War on Drugs – is the exact opposite of social equity.

We know for a fact that people of color suffered exponentially more from the War on Drugs than white people did, so these proposed regulations will inevitably keep more people of color out of the legal marketplace.

Dropping the blanket assumption that their past charges automatically make them incapable of operating in compliance with a regulated market is among the grossest forms of discrimination.

So that’s bad. Really bad. But you guessed it, it gets worse.

The next line in Section 5 of the MORE Act covers the potential for suspending or revoking federal cannabis permits. Once again, immense power is given to the Secretary of Treasury who would have the right to demand that any federal licensee who has EVER been entangled in ANY “previous or current legal proceeding involving a felony violation of Federal or State criminal law relating to cannabis” somehow prove to the federal government in writing that they intend to remain compliant.

The case was 15 years ago? Too bad.

You were eventually acquitted? Too bad.

As Mr. Figueroa summed up in his coverage, “Such language would encompass individuals facing a situation where no criminal charges of any kind were filed after an arrest, but an asset forfeiture proceeding alleging felony violations was initiated and in the end dismissed with the return of all seized assets.”

So you can be falsely accused of a crime, prove your innocence, then have the Secretary of Treasury demand that you prove it one more time to his/her satisfaction. So, we are not only going backward on social equity but on criminal justice as well?

This disincentivizes folks from taking the hurdle-strewn path to the regulated market.

The MORE Act cannot be allowed to fuel its own expungement effort by creating new criminals.

THE FIX (IT’S EASY, TOO!)

We stand with Mr. Figueroa in our demand that Section 5 of the MORE Act be re-amended immediately, before being reconciled in the Senate.

We stand with Mr. Figueroa in our demand that Section 5 of the MORE Act be re-amended immediately, before being reconciled in the Senate.

It’s an easy re-write. Just say the opposite. Everyone adversely affected by our past/flawed cannabis laws and the criminal justice system should be protected under the MORE Act. If they choose to enter the legal marketplace, they should be able to do so without fear that those past charges could affect their future endeavors.

Who knows? Maybe the Secretary of Treasury will be a friend to the cannabis movement under the next administration. But what about the one after that? We have to minimize that power and potential for corruption, and changing the language in Section 5 is a mandatory and logical step in that process.

We reached out to our friend and deeply respected cannabis and veterans’ advocate Eric Goepel of Veterans Cannabis Coalition for his take on the latest version of the MORE Act, and he pushed back on our critique a bit. On the issue of a 5% federal excise tax on cannabis, Goepel says, “We don’t trust that conservative state legislatures will devote any time or money to restorative justice, which makes the federal excise tax necessary so we don’t perpetuate unequal justice where a resident in one state is unable to pursue expungement because lawmakers refuse to fund appropriate efforts.” He added that federal decriminalization of cannabis would eliminate so many of the current barriers to profitability (ie. tax code 280e) that more affordable pricing could absorb the impact that the added tax might have on retail consumers’ wallets. He told us to watch for the MORE Act to resurface sometime around mid-2021, perhaps with some newly amended language.

This is an exciting time in the world of cannabis advocacy. We have worked so hard to get to this point, though, we cannot settle for less than we know we all deserve.

You can help! Contact your local lawmakers today and let them know that the MORE Act needs more work.

- Facebook and Instagram Loosen Cannabis Restrictions, But Is It Enough From Meta?

- Combating Violent and Dangerous Crime Act Targets “Candy-Flavored” Cannabis Products

- Retail Spotlight – Mayflower in Lowell, MA

- Benzinga Chicago 2025 Recap

- Iowa’s Surprising Veto of Psilocybin Bill HF 383

- North Carolina House Bill 328 and the Growing Trend of Hemp Regulation in the U.S.