New York City recently announced the launch of its Cannabis NYC Loan Fund, which provides equity applicants with low-cost capital to get their cannabis facilities operational in the city.

The fund is part of an effort to promote cannabis industry equity by supporting entrepreneurs most impacted by the drug war.

The goal of the Loan Fund is to provide flexible capital at below-market rates to cannabis businesses that are run by Social and Economic Equity Applicants who have been awarded licenses to operate in New York City.

NYCEDC will commit up to $8 million of subordinated loan capital at a 0% interest rate, with the intention of attracting private capital to leverage fund size and impact while bringing down overall interest rates for Loan Fund borrowers. Loans will be coupled with technical assistance to increase the likelihood of borrower success and mitigate the risk of default.

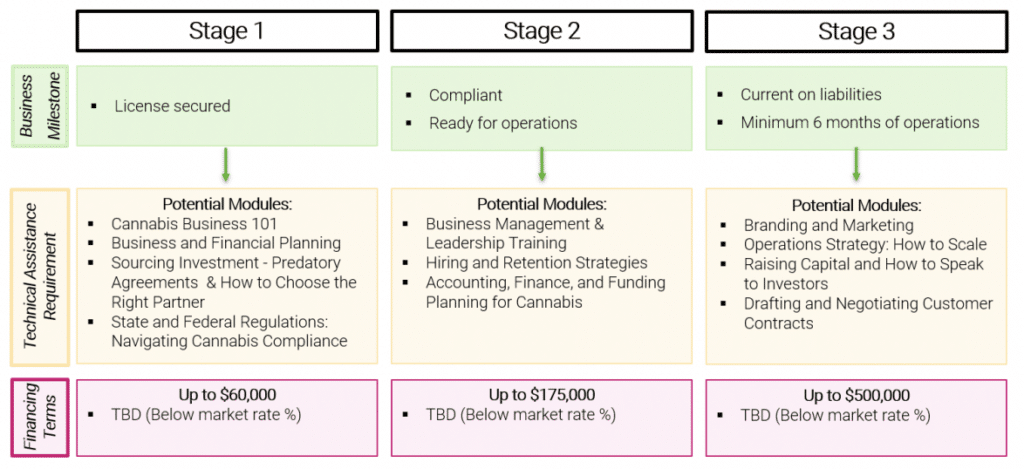

The program consists of three milestone-based loans up to $60,000, $175,000, and $500,000, respectively.

As businesses reach certain milestones, they can apply for additional loans of increasing size. In order to access subsequent, larger loans, companies must meet certain operation milestones, and entrepreneurs must complete related technical assistance requirements.

This approach allows the fund to protect against losses while also helping businesses have a higher chance of success by allocating more dollars.

“Legalizing cannabis brought great promise of progress towards social and economic equity, but we cannot sit on our hands while illegal smoke shops crowd out the New Yorkers and communities who were disproportionately harmed by the ‘War on Drugs’ — now that they have an opportunity for justice,” said New York City Mayor Eric Adams.

Benefit to Equity Applicants

The Cannabis NYC Loan Fund offers great opportunities to applicants with equity backgrounds who are looking to establish cannabis businesses in New York City.

This program provides low-cost financing options for entrepreneurs negatively impacted by the drug war. The fund is supported through an initial commitment of $8 million from the New York City Economic Development Corporation and the Department of Small Business Services, thus making it possible for deserving entrepreneurs who lack access to capital to get their businesses operational.

These two entities have committed themselves to providing technical and business assistance to entrepreneurs as well so that they can succeed in navigating this complex cannabis market.

Through workshops, training sessions, and other such initiatives, NYCEDC and SBS will be able to provide aspiring business owners with all the necessary knowledge and skills to understand industry regulations, access local resources and launch their businesses.

In addition to technical assistance, NYCEDC and SBS will also be providing support in market outreach so that entrepreneurs can identify potential customers and develop robust marketing strategies. By offering such comprehensive support, the Cannabis NYC Loan Fund ensures that equity applicants have the necessary resources to succeed in this new cannabis industry.

Tiered Structure of Loans

The tiered structure of the Cannabis NYC Loan Fund is designed to protect both lenders and borrowers. Businesses can access loans up to $60,000 right away, but in order to qualify for subsequent loans of up to $175,000 and then $500,000, they need to meet specific operational milestones.

These could include securing a license, being ready for operations, and a minimum of 6 months of operations. Once these benchmarks are achieved, businesses can apply for additional funds that will enable them to expand their operations even further.

By having a milestone-based loan approval system, the fund seeks to ensure that businesses with higher success potential receive more capital and those with lower chances of making it in this competitive industry get limited funds.

This helps protect against losses while also enabling those businesses that have proven themselves successful over time to grow at a faster pace.

This initiative is commendable and will hopefully positively impact the industry in the near future. The Cannabis NYC Loan Fund is undoubtedly a welcome move for entrepreneurs with equity backgrounds and a step towards creating an inclusive cannabis industry in New York City.

It allows equity applicants to access funds at low costs. Also, it provides them with the necessary support from NYCEDC and SBS to overcome challenges related to setting up their businesses. With its milestone-based loan approval system, the fund seeks to protect lenders while ensuring that more capital goes towards those businesses that have proven themselves successful over time.

“The Cannabis NYC Loan Fund will help cement New York City as a trailblazer in equitable cannabis industry investments. This fund is committed to boosting an emerging industry while also uplifting underrepresented New Yorkers, particularly those unfairly impacted by antiquated cannabis policy. We look forward to working alongside our partners in the public and private sector to continue creating a vibrant, inclusive, and globally competitive economy for all New Yorkers.” said NYCEDC President & CEO Andrew Kimball.

While it remains to be seen if this program proves successful, it’s clear that New York City officials are making sure to take all the necessary steps toward creating an equitable cannabis industry.

Finally, it’s important to note that this fund is only one of the many initiatives taken by New York City in its attempt to promote equity in the cannabis sector.

As more states move towards legalization, it’ll be interesting to see how other cities follow suit and launch similar programs aimed at helping social equity applicants.

Enjoyed that first hit? Come chill with us every week at the Friday Sesh for a freshly packed bowl of the week’s best cannabis news!

- Chicago Police Department Revises Policy on Searches Based Solely on Marijuana Odor

- Ohio’s Senate Bill 56 Postponed, Leaving Details of Issue 2 Still Unresolved

- Sports Stars and Well Known Entertainers Join Forces Calling on Trump for Cannabis Reform

- Pinsky and the Brain: Bill White on His Journey to Consulting in Cannabis

- Delaware’s Recreational Cannabis Market Finally Set to Launch After Years of Challenges

- Excise Tax Increase to 19% and Its Impact on California Retailers